Last week was a quieter week for FX markets as there were little global data with only the PMI the main releases.

The continued rolling back by the Fed and ECB of any rate cuts has seen a strong USD theme over the last few weeks and months. Last week saw a small respite as the DXY lost 0.3% but the JPY continued to lose ground against the greenback.

Both the GBP and EUR had quiet weeks with both gaining around 0.4% vs the USD. UK Data was light with consumer sentiment falling for the first time in 4 months as interest rates bite into personal finances. ECB released their minutes with the slowdown in Eurozone inflation being the main highlight, but strong wage growth continues to hamper any ability for interest rates being cut in the near term.

Commodity currencies struggled for any real gains despite the risk on appetite in stocks. The tech led gains pushed stocks to new highs, but commodity currencies gains were hampered as Oil took a loss on the week.

The week ahead we have more economic releases than last week. We have PMI and US Core PCE which will give us a strong indication of where the Fed’s next move may be. We also have the RBA rate decision.

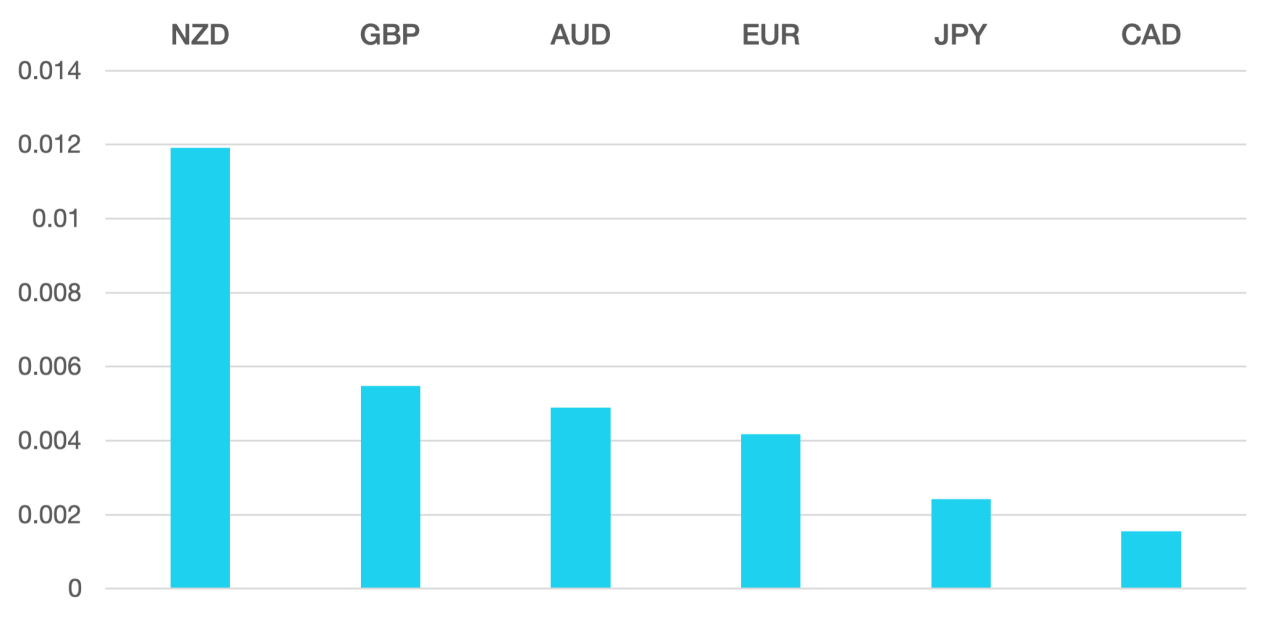

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post FX Volatility Lower For The Week first appeared on trademakers.

The post FX Volatility Lower For The Week first appeared on JP Fund Services.

The post FX Volatility Lower For The Week appeared first on JP Fund Services.