The US dollar was back in the driver’s seat on Thursday, with the EUR/USD declining sharply following news that Greece made a crucial loan payment to the International Monetary Fund.

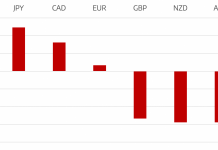

The US dollar index, a trade-weighted average of the dollar against a basket of six currencies, advanced 0.72% to 98.65.

The dollar advanced briskly against the euro, which continued to drift lower amid escalating tensions between Greece and Germany over Athens’ demand for WWII reparations. The EUR/USD plunged 100 pips to 1.0686.

On Thursday Greece announced that it had scheduled a €460 million payment to the International Monetary Fund, dismissing rumours that the government was prepared to default to the international lender. The payment buys Greece some time to negotiate a longer term settlement on its outstanding debt.

Elsewhere, the dollar advanced against the British pound, as the GBP/USD fell 125 pips to 1.4725. The pound was under pressure after the Bank of England left its key interest rate unchanged at 0.5% until after the May general election.

The greenback also advanced against the Canadian dollar, as the USD/CAD re-tested the 1.2600 level. The pair advanced 0.4% to 1.2590.

The USD/CHF soared more than 100 pips to reach 0.9767 intraday trade. It would subsequently consolidate at 0.9758, advancing 95 pips.

The US dollar responded positively to Federal Reserve deliberations showing a near-consensus on adjusting the forward guidance. Nearly all of the voting FOMC members agreed to remove the word “patient” from the official policy statement, signaling that the central bank was edging closer to normalizing interest rates. However, policymakers were divided on when to begin adjusting interest rates, suggesting that economic data would provide the deciding factor.

“Several” Fed officials thought June would be the appropriate time to begin hiking interest rates, but others thought it would be better to wait longer. The federal funds rate is expected to edge up to 0.625% by the end of 2015, according to the Fed’s summary of economic projections. According to analysts, the first rate adjustment will likely occur in September.

In economic data, US wholesale inventories rose faster than forecast in February, the Department of Commerce reported on Thursday. Inventories rose 0.3%, although wholesale sales dropped 0.2%. The inventory-to-sales ratio at the end of February was 1.29.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading