Once again TradersDNA has the opportunity to share with its audience; Trapped Traders Trade of the Day Analysis.

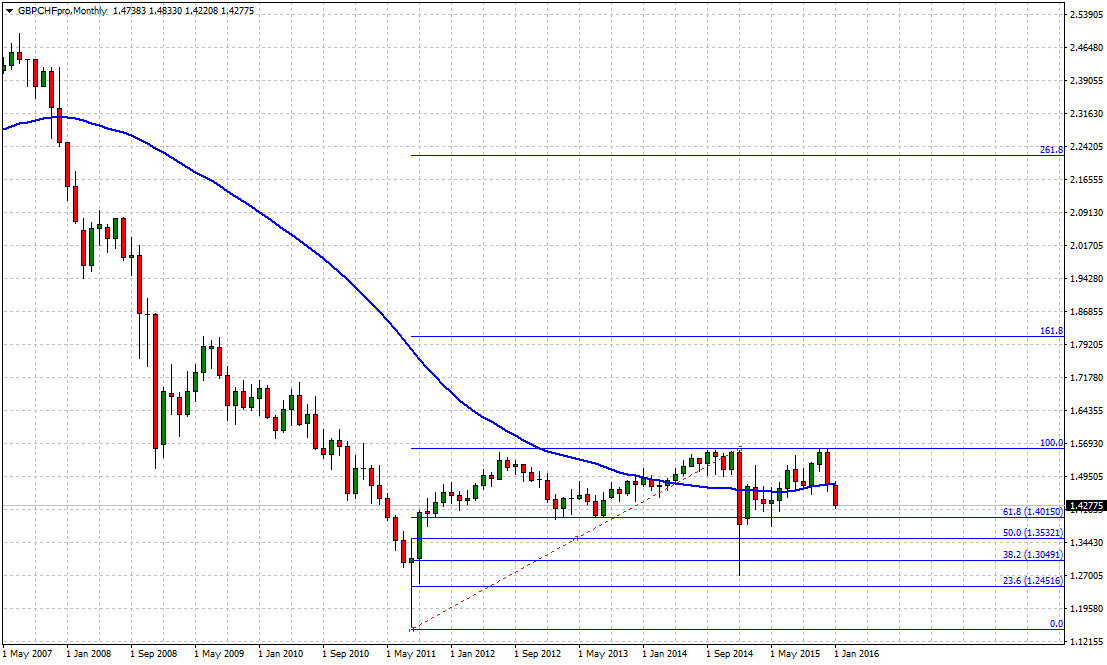

Big theme for today is definitely risk off as investors flee the stock market looking to park their money in safe havens, which means the Japanese Yen and the Swiss Franc will benefit from this flight to quality. The trap I’m going to be looking at today is called a trap break pullback.

It’s not quite a trade just yet. I need to see prices sell off a little more, but then if it pulls back into that 0.8120 to 0.8140 area and you get some confirming price action to the downside. Try and look for commodity-based currencies, which at the moment are struggling, to trade against (i.e., the USDCAD, the AUDUSD, the NZDUSD, and the USDNOK).

Trapped Traders® is a daily/weekly publication designed by Forex Traders Daily – All Rights Reserved. We encourage traders/investors to review Mark Chapman’s trading methodology; Trapped Traders.

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.