The British pound rallied against the US dollar on Tuesday, reversing nearly five-year lows following a deluge of economic data from the UK and United States.

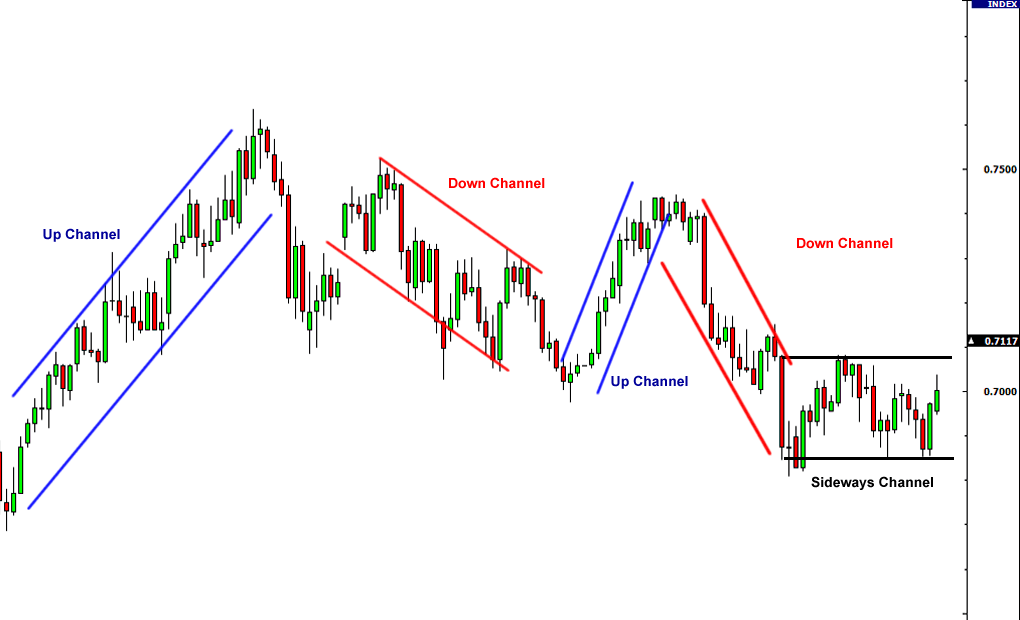

The GBP/USD climbed to a session high of 1.4788 in European trade. It would subsequently consolidate at 1.4677, advancing 0.61%. The GBP/USD is slightly bullish on the 1-hour chart, as the pair looks to close above the 1.4760 resistance. That would expose 1.4836 as the next target. On the downside, initial support is located at 1.4600.

The GBP/USD plunged last week and extended its losses in the early Monday session, where it bottomed out at 1.4573. The pound came under pressure after the Bank of England maintained the status quo with regards to monetary policy, signaling the first time since the Second World War that interest rates have been left unchanged for the duration of parliament. The UK heads to the polls on May 7 to elect a new government in what many describe as the closest elections in decades.

The pound was unable to extend its rally against the euro, as the EUR/GBP climbed 0.21% to 0.7216. The pair faces near-term support at 0.7174 and resistance at 0.7250.

The Office for National Statistics released a deluge of inflationary data on Tuesday, headlined by the consumer price index. UK consumer prices climbed 0.2% in March, following a 0.3% increase the previous month. Year-on-year, the CPI rate was zero, as expected by the consensus. So-called core inflation rose 1% annually, down from 1.2% the previous month.

The retail price index climbed 0.9% annually in March, official data showed. Meanwhile, producer inflation climbed 0.2% from a month ago.

In the United States, retail sales rose in March for the first time in four months, easing concerns about a broader economic slowdown. Retail sales climbed 0.9% to $441.4 billion, the biggest increase in a year.

The US dollar weakened across the board on Tuesday, as investors scaled back their rate-hike expectations. The dollar index pared last week’s gains by declining 0.82% to 98.67. Dollar pairs could face greater volatility in the coming days amid a steady stream of economic data, featuring March CPI, and several Federal Reserve speeches.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading