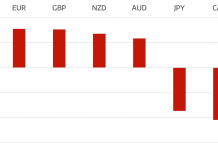

The EUR/USD climbed to higher ground on Thursday, advancing for a fourth consecutive day amid broad US dollar weakness.

The EUR/USD climbed to a session high of 1.1443, its highest level since February. It would later consolidate at 1.1394, advancing 0.4%. Initial support is likely found at 1.1243 and resistance at 1.1424.

The EUR/USD has advanced around 2% since Monday and is now trading above its long-run averages (SMA100 and SMA200). The common currency was supported on Wednesday after the European Commission said Eurozone GDP expanded in the first quarter, with Germany, France, Italy and Spain all registering growth.

The euro area economy has gained traction since the European Central Bank embarked on a massive stimulus program. The ECB will inject more than €1 trillion into the Eurozone over the next year-and-a-half to promote economic growth and rebalance inflation. Those measures came after repeated rate cuts and the introduction of a negative deposit rate.

The US dollar is trading at its lowest level in nearly four months, according to the exchange-weighted index. The dollar index declined by another 0.25% on Thursday, falling to 93.38. That was its lowest level since January.

The dollar failed to rally after the Department of Labor said initial jobless claims fell to another 15-year low last week. The number of Americans filing for first-time unemployment benefits fell by 1,000 to a seasonally adjusted 264,000 in the week ended May 9. Economists forecast an increase of 10,000 to 275,000.

The four-week moving average for initial jobless claims, which controls against week-to-week volatility, fell to its lowest level since April 2000.

Thursday’s data suggest that the US labour market was gradually regaining its footing after a disappointing month of March. Last week the Department of Labor said nonfarm payrolls rose by 223,000 in April, roughly in line with the consensus forecast. The unemployment rate fell to a new seven-year low of 5.4%. The unemployment is expected to fall further toward 5% in the remainder of the year, according to latest projections by the Federal Open Market Committee.

The FOMC is keeping a lid on monetary policy for the time being, as it assesses the economy’s recovery following the first quarter slowdown that saw GDP expand just 0.2% annually.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading