The EUR/USD was little changed on Monday, holding above the psychological 1.10 level after plunging 3% last week on signs the European Central Bank was prepared to expand its stimulus program.

The EUR/USD was trading at 1.1016 at the start of the North American session, relatively unchanged from the previous close. The EUR/USD briefly traded below 1.10 last Friday amid a two-day drop that sent the pair plunging more than 300 pips.

The EUR/USD faces a negative short-term outlook according to the moving averages and technical indicators. The RSI indicator is approaching oversold levels, according to the daily chart. The pair is likely to face immediate support at the psychological 1.1000 level. Initial resistance is likely found at 1.1098, the 200-day simple moving average.

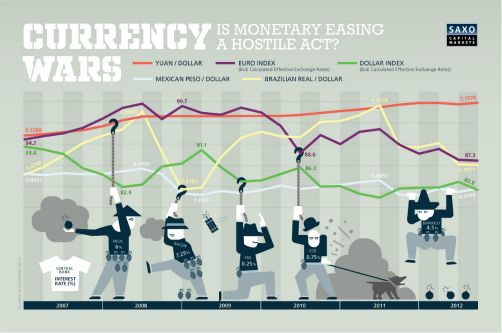

Underpinning the euro’s recent struggle has been a surging US dollar. The greenback rose more than 2% against a basket of world currencies last week, reaching its highest level since August after China introduced new stimulus measures.

The dollar index eased off its recent highs on Monday, falling 0.2% to 96.98.

Expectations for additional stimulus measures by the European Central Bank have also weighed on the EUR/USD exchange rate. ECB President Mario Draghi vowed last week to expand the Bank’s quantitative easing program and cut rates further in order to promote inflation and economic growth in the euro area region.

Both Germany and the Eurozone will release preliminary inflation figures later this week. Germany’s harmonized index of consumer prices is forecast to rise 0.1% annually in October after falling 0.2% the previous month. Eurozone inflation is forecast to improve to zero in the 12 months through October after falling 0.1% the month before.

German business confidence deteriorated less than forecast in October, the Munich-based Ifo Institute reported Monday. The Ifo business confidence index fell to 108.2 in October from 108.5 the previous month, the lowest level since July. However, a broad consensus of economists forecast a drop to 107.8.

“The Volkswagen scandal has had no impact on the German automotive industry,” said Ifo President Hans-Werner Sinn.

Nevertheless, “The German economy is proving remarkably resilient in view of this autumn’s multiple challenges,” Mr. Sinn added.

Global stocks traded mixed on Monday ahead of an active week that features several earnings reports, key economic data and interest rate decisions by the Federal Reserve and Bank of Japan. The Fed is widely expected to keep its key rate unchanged this week, providing an additional catalyst for global stocks.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading