The EUR/USD declined on Monday, as risk sentiment return to the financial markets after Greece and its Eurozone partners reached an 11th hour deal to keep Athens funded and part of the Eurozone.

The EUR/USD fell back toward the mid-1.10 region after climbing to an intraday high of 1.1198. The EUR/USD consolidated at 1.1055 in the early New York session, down 0.5% or 60 pips. The EUR/USD is likely to face immediate support at 1.1050, the March 26 low, followed by the psychological 1.10 level. On the upside, initial resistance for the EUR/USD is likely seen at 1.1245, followed by 1.1324.

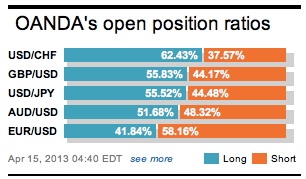

Funding currencies like the euro were on their heels on Monday, as investors opted for the US dollar. The dollar index, a trade-weighted average of the US dollar against a basket of six currencies, rose 0.5% to 96.52.

Risk-on sentiment returned to the markets after Eurozone finance ministers reached an agreement on Greece. The new agreement, which came after 17 hours of negotiations, will provide Athens with up to €86 billion over three years in exchange for strict economic and fiscal reforms. The agreement was reached “unanimously,” according to European Council President Donald Tusk.

As part of the deal, Athens agreed to set up a €50 billion fund to repay its debt, according to Eurogroup President Jeroen Dijsselbloem. The new bailout agreement would affect Greece’s pension system, product markets, privatization and labour, according to German Chancellor Angela Merkel.

Greek parliament must pass all the reform laws by July 15 in order for the new bailout to take effect.

Tension reached a boiling point over the weekend after German finance minister Wolfgang Schauble drafted a proposal calling for a “temporary Grexit” should Greece not accept the austerity measures. According to analysts, the deal that Greece accepted on Monday was more far-reaching than the one rejected by more than 61% of Greeks at last week’s national referendum.

European stock indices rose across the board on Monday, signaling renewed optimism following the bailout agreement. All of the major exchanges in London, Frankfurt, Paris and Madrid posted sharp gains.

The EUR/USD could face more price action later this week, as Germany and the European Commission are scheduled to release final June CPI figures. On Thursday the European Central Bank will also issue its July rate statement.

In the United States, key data this week include retail sales, industrial production, housing starts and CPI.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading