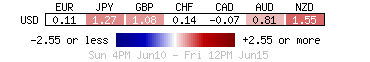

In Association with OANDA Corporation

Report by Dean Popplewell

Week in FX Europe June 10-15

The Greek elections this weekend can accelerate the rise in market stress. Investors are going into the weekend cautions given Sunday’s election in Greece in which the radical left Syriza could win the election. However, analysts note that even with the extra 50 seats that go with winning first place, the left will not have a majority and will have to convince a partner to join it in order to form

EUROPE Week in FX

Yen Rise Noda Fundamentals

The BoJ 2-day meeting left its monetary policy unchanged, left its asset-purchase size unchanged at +JPY40t and its credit lending program unchanged at +JPY30t. That was in line with market expectations. The BOJ said it will pay “particular” attention to the global markets in an implicit promise to help ease any market strains that might emerge after the Greek election.

ASIA Week in FX

Greece First and then the FED

The turmoil in the Euro-zone is nearing fever pitch. Europe’s escalating debt crisis is emerging as a top concern for both Governor Carney at the BoC and the Fed. Thrown in data showing that the euro-zone and US economies are slowing, which means fears of global contagion are real, could be pushing the Fed closer to more bond buying or extending “operation twist”.

AMERICAS Week in FX

WEEK AHEAD

- Asset classes await the Greek election outcome on Sunday

- GBP has Claimant count changes, CPI and MPC meeting minutes to contend with

- Sales data is delivered from GBP and CAD

- EUR is expected to be influenced by German economic and business sentiment

- USD has the Fed to contend with midweek. Hints of QE3?

- G20 meetings will monitor this week’s global events

- USD has weekly claims, existing home sales and Philly Fed Manufacturing to digest

- Midweek has CNY flash manufacturing and NZD growth numbers to deliver

- Core CPI rounds off the event risk week for CAD

Top 100 Forex Traders Statistics : Review the day’s successful and unsuccessful forex trading strategies here.

Forex Open Position Ratios

[embedit snippet=”forex-open-position-ratios”]

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading