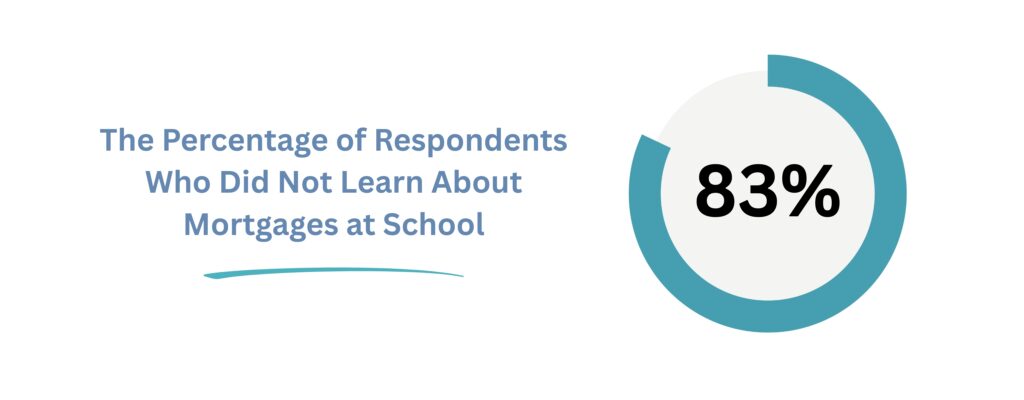

A recent study by Boon Brokers reveals that despite Financial Literacy being introduced into the UK National Curriculum in 2014, most young adults still lack essential mortgage knowledge. With 83% not learning about mortgages in school and 67% overestimating their understanding, the research highlights the urgent need for improved, practical financial education in schools, particularly regarding mortgages.

A new study by Boon Brokers reveals alarming gaps in the financial education of young adults in the UK, despite the introduction of financial literacy into the National Curriculum over a decade ago. The research highlights that many young people are leaving school with a concerning lack of understanding of fundamental financial concepts, especially regarding mortgages.

The study, conducted by Savanta Research Group, surveyed 1,000 young adults aged 18 to 24 across the UK. It specifically examined the level of knowledge young people have about mortgages and how they acquire financial education. Despite the rollout of Financial Literacy as part of the National Curriculum in 2014, a large proportion of the target age group has not received the necessary guidance on managing their finances.

Key findings: Financial education falls short

The research reveals that:

- 83% of young adults did not consider school as their main source of education on finance and mortgages.

- 92% of young adults believe that mortgages should be taught in schools.

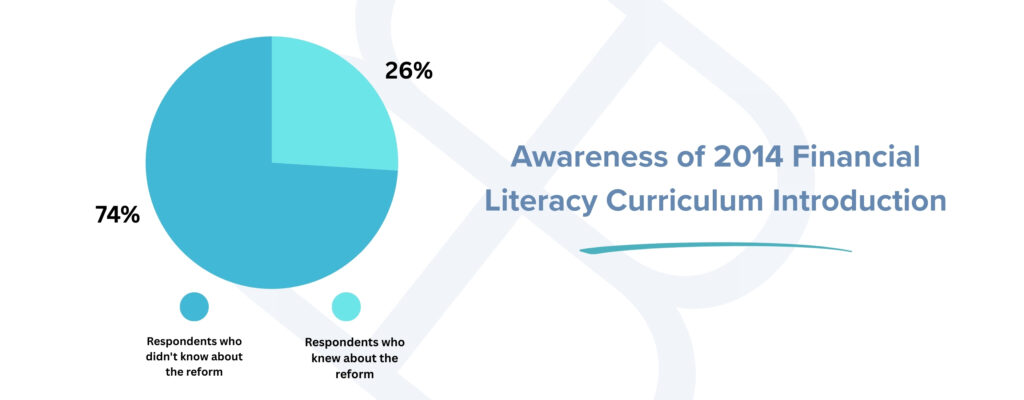

- 74% of young adults were unaware that Financial Literacy was part of the National Curriculum.

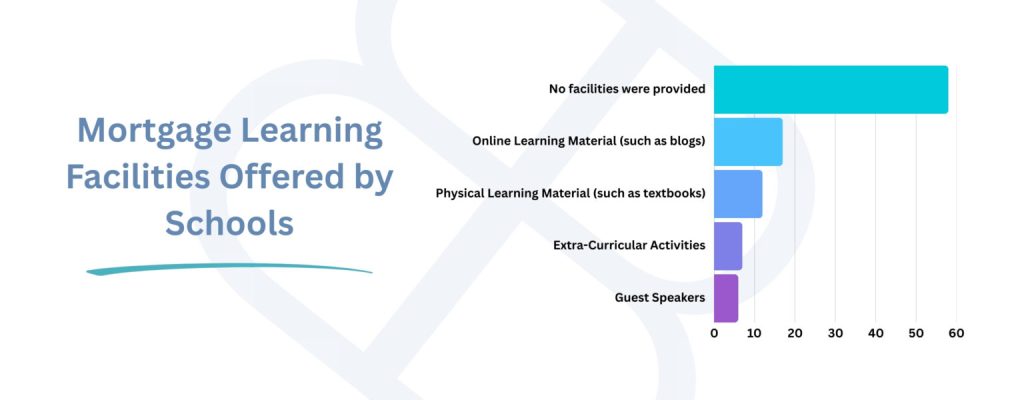

- 58% of young adults reported that no facilities were provided at school to learn about mortgages.

- 39% of young adults rely on their parents as their primary source of financial education.

- Despite the gaps in their financial understanding, 67% of young adults mistakenly believe they have an above-average understanding of mortgages.

Gerard Boon, Managing Director of Boon Brokers, notes, “The current financial education in the UK is not equipping the young people of today with the financial skills they need to navigate real-world financial responsibilities.”

The role of parents and social media

The survey further highlights that, for many young adults, parents are the primary source of mortgage knowledge. This reliance on parents can perpetuate outdated information, creating a cycle of misinformation passed down from generation to generation. Additionally, 14% of respondents listed social media as a key source of financial education, with a 3% gap between social media and schools.

This shift in where young people are seeking financial advice demonstrates the growing influence of online platforms, where unqualified ‘influencers’ may be offering advice on complex financial matters. While online learning can be a useful tool, the lack of structure and depth in such sources raises concerns about its effectiveness for teaching essential life skills like mortgage management.

A lack of formal education on mortgages

The study also uncovered that a significant percentage of young adults feel unprepared to handle the financial responsibilities of a mortgage. While the 2014 curriculum reform aimed to cover topics such as income, expenditure, credit, debt, savings, and financial products – all of which are closely linked to mortgages – it is evident that these areas are not being adequately addressed in schools.

In particular, 58% of young adults stated that no facilities or resources were available at school for learning about mortgages. This lack of access to structured learning, even ten years after the curriculum reform, is concerning.

The “Invisible Curriculum” and a growing blind spot

Perhaps the most revealing statistic is that 74% of respondents were unaware that financial literacy was even a part of the National Curriculum. This lack of awareness raises significant questions about the effectiveness of the current financial education system. “If young people don’t know that financial education is being taught, then how can we expect them to notably learn from it?” says Boon.

This research shows that despite financial literacy being included in the curriculum, its impact has been minimal. Young adults, who are the first generation expected to benefit from the reform, have not had adequate exposure to essential financial concepts, including mortgages.

The growing need for mortgage education

The study underscores the importance of mortgage education. With homeownership becoming an increasingly significant financial milestone for many young adults, it is essential that they are equipped with the knowledge to make informed decisions about mortgages. Boon argues that, “To prevent a generation from unknowingly walking into poor mortgage decisions and long-term debt, a new focus on practical and relevant financial education is urgently needed.”

Boon Brokers’ findings highlight a pressing issue in the UK’s financial education system. Despite a decade of reforms, young adults are still not receiving the necessary education to understand financial commitments, particularly mortgages. While there is a strong desire among young adults to learn about mortgages – 92% rated it as important – the current educational structures are failing to meet this need.

The research calls for an urgent overhaul of how financial education is taught, making mortgage knowledge a mandatory inclusion in the curriculum. It’s clear that young people need more than theoretical financial literacy – they need practical, accessible, and structured education to navigate life’s major financial commitments.

About Boon Brokers

Boon Brokers, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the UK, is led by Gerard Boon (B.A Hons, CeMAP, CeRER). With a client base of over 9,000 across the country, Boon Brokers is committed to providing expert mortgage advice and services. Boon is passionate about integrating artificial intelligence into the financial services industry and aims to update his research on this subject following the findings of this survey.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.