According to a recent report by BNP Paribas, globally, non-cash transaction volumes continues to grow at double digit growth rates since 2015. Overall, volumes grew by 10.1% to reach a total of 482.6 billion. The main growth regions during the period were Emerging Asia and Central Europe, Middle East, and Africa (CEMEA). The report also points out that there is increasing evidence that high levels of non-cash transactions can benefit society in a number of ways and can even help to solve challenging problems, such as corruption and payments fraud.

Solving those problems might just be what’s behind the drastic change in Portugal’s payments ecosystem, one of the developed countries in the EU: from one cash-driven system to other e-payment based. The country has made important steps towards embracing a e-payments transactions. Firstly, the introduction of SCT Inst – a pan-European instant payment scheme – in Portugal in September 2018 was a positive move in this direction, and secondly, the central bank –Banco de Portugal– had enacted a regulation enabling the financial institutions in the country to allow their customers to open bank accounts online. It seems the efforts are paying off.

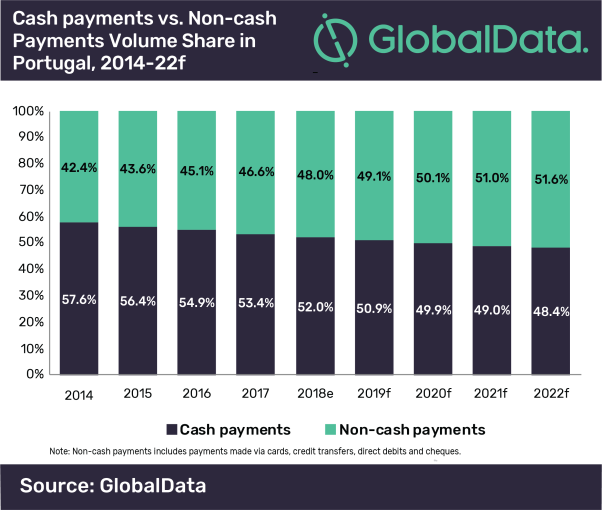

Even though, cash remains the most preferred mode of consumer payment currently in Portugal, electronic payments are set to surpass it by 2020, supported by government initiatives and improved payment infrastructure, according to GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Payments Landscape in Portugal: Opportunities and Risks to 2022’, reveals that the share of cash in total payment volume decreased from 57.6% in 2014 to 52.0% in 2018 and is expected to drop further to 48.4% by 2022.

The benefits of paying by electronic means are numerous from the consumer and business perspectives. First of all, it reduces transaction costs as there are usually no fees to swipe your card or pay online. In the long run, e-payment could save both individuals and businesses hundreds to thousands of dollars in transaction fees. Likewise, it increases speed and convenience as well as it boosts sales. E-payment methods are crucial in the e-commerce boom of these years. It works 24/7 and facilitate shopping through digital shops.

While in many countries e-payments have surpassed by far to those made on cash, Portugal, as developed country, still relied heavily on cash for everyday payments. However, this is changing at a high pace in recent years, as GlobalData has found.

Nikhil Reddy, Payments Analyst for GlobalData, comments: “The implementation of an instant payment system, cap on cash transactions and the push for digital banking are expected to help the country move towards a digital economy.”

The introduction of SCT Inst – a pan-European instant payment scheme – in Portugal in September 2018 was a positive move in this direction. It enables peer-to-peer electronic fund transfers of up to €15,000 (US$17,183.22) in real-time within 10 seconds and is available 24/7.

To reduce the dependence on cash and promote electronic payments, the government capped the amount of cash per transaction for residents and non-residents to €3,000 (US$3,436.64) and €10,000 (US$11,455.48), respectively in August 2017. The government also mandated income tax payments over €1,000 (US$1,145.55) to be made through bank transfer, cheque or direct debit.

One month prior to this, the central bank–Banco de Portugal–had enacted a regulation enabling the financial institutions in the country to allow their customers to open bank accounts online. With this, several banks such as Novo Banco, Millennium BCP and Santander allowed consumers to open bank accounts through digital channels.

Reddy concludes: “These initiatives are likely to displace cash to a certain extent in favor of electronic payments during the forecast period.”

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.