Trading is an old business, a very old one. Almost every community have somehow trade assets of all sorts to each other since the beginning of civilization. And while the very final goal of it remains intact, what changes over the years is the different technologies and assets used to make a given exchange happen. All along, players involved in trading have had to update their practices to these new techniques and newborn trading tokens, so the thin balance between buyer/seller can be kept in relatively good harmony, a role that has been hold by regulators over time.

In the financial industry, a relatively new marketplace, this balance has been recently broken by a new emerging market: the one based on cryptocurrency. This is a wild plaza, open 24/7 and based on digital coins and completely online. There are no other physical references for a cryptocurrency rather than values given by digital exchanges. And these get more crowded day after day by newly created tokens out of ICOs and other practises.

Nonetheless, far from being rejected, the cryptocurrency market offers challenges that need to be sorted, not refused; and opportunities that have to be taken, not missed. Its story is short but intense and need to be told to fully understand where we are and where are we heading to.

For that, we have invited Pedro Borges to tell us more about this thrilling market, full of challenges and opportunities. Mr Borges, with over 20 years’ international financial trading services experience, has led major institutions across countries in the two hemispheres holding progressive leadership roles.

His expertise and extensive career has been forged along these years with a proactive personality in digital banking and online trading/brokerage – in terms of creating ‘state-of-art’ customer experiences, and transforming key internal support functions to fully align with the overall goal – he has been going through all the different stages of online trading and investment digital transformations. He is now deeply involved in the new blockchain / crypto / tokens / ICO world having created and leading projects such ICO Sofa, Aprendersobrebitcoin.com.br and many other projects that bridge crypto, exchanges and token economics through media and educational perspective.

Here are his views about the cryptocurrency market:

The Past – Where we come from

If you look at the history of trading lots has been happening in the last 50 years but it is a new industry. In 1969, an aerospace analyst built the first ECN: Instinet. He saw it as way to eliminate the brokerage industry and the exchanges. In the early 1980’s Bill Lupien, a Pacific Exchange specialist, took the company over.

This created a new industry and by the time Reuters bought Lupien out in 1988, ECNs were becoming the way most NASDAQ stock were valued and traded. Instinet quickly became the preferred method for large-scale professional investors to trade in multiple exchanges and over-the-counter systems (Millman, 56).

In 1994, the economists William Christie and Paul Schultz published a paper that described an anomaly that they had discovered when examining computer-collected data of stock prices on NASDAQ. The brokers that are responsible for maintaining liquidity on NASDAQ are called market makers. They make their money from the difference between what the buy and sell prices listed on NASDAQ, known as the spread. Christie and Shultz found that the market makers where colluding to keep the spreads artificially high. The paper led to investigations by the Justice Department and rule changes by the SEC. The market makers used ECNs to carry out the truly competitive trading amongst each other, so the SEC made it mandatory for the ECN prices to be listed on NASDAQ, and they changed the order-handling rules to the benefit of small investors. The rule changes cleared the way for new ECNs that were available to anyone, such as Island.

Since 1996 the World Wide Web gained momentum and discount online brokerages such as E-Trade and Ameritrade were becoming very popular. They offered extremely low commissions and complete control over your portfolio.

Conventional discount brokerage firms such as Charles Schwab and TD Waterhouse began offering more online services for less money, while still providing personal advice from its brokers (Ecommerce).

Electronic trading was becoming so popular; it was actually encroaching on the profits of traditional brokerages like Goldman Sachs and Merrill Lynch (Ecommerce).

The growth of online investing has been explosive, (1.1 million in 2000 to 7.2 million in 2003) it has been limited the 40% of the population that already own stocks.

After this came the forex online trading industry revolution in the 80s that I was part of. The foreign exchange market (Forex, FX, or currency market) became the major global decentralized or over-the-counter (OTC) market for the trading of currencies.Players such as FXCM, Oanda, Saxo Bank made the industry evolve very fast.

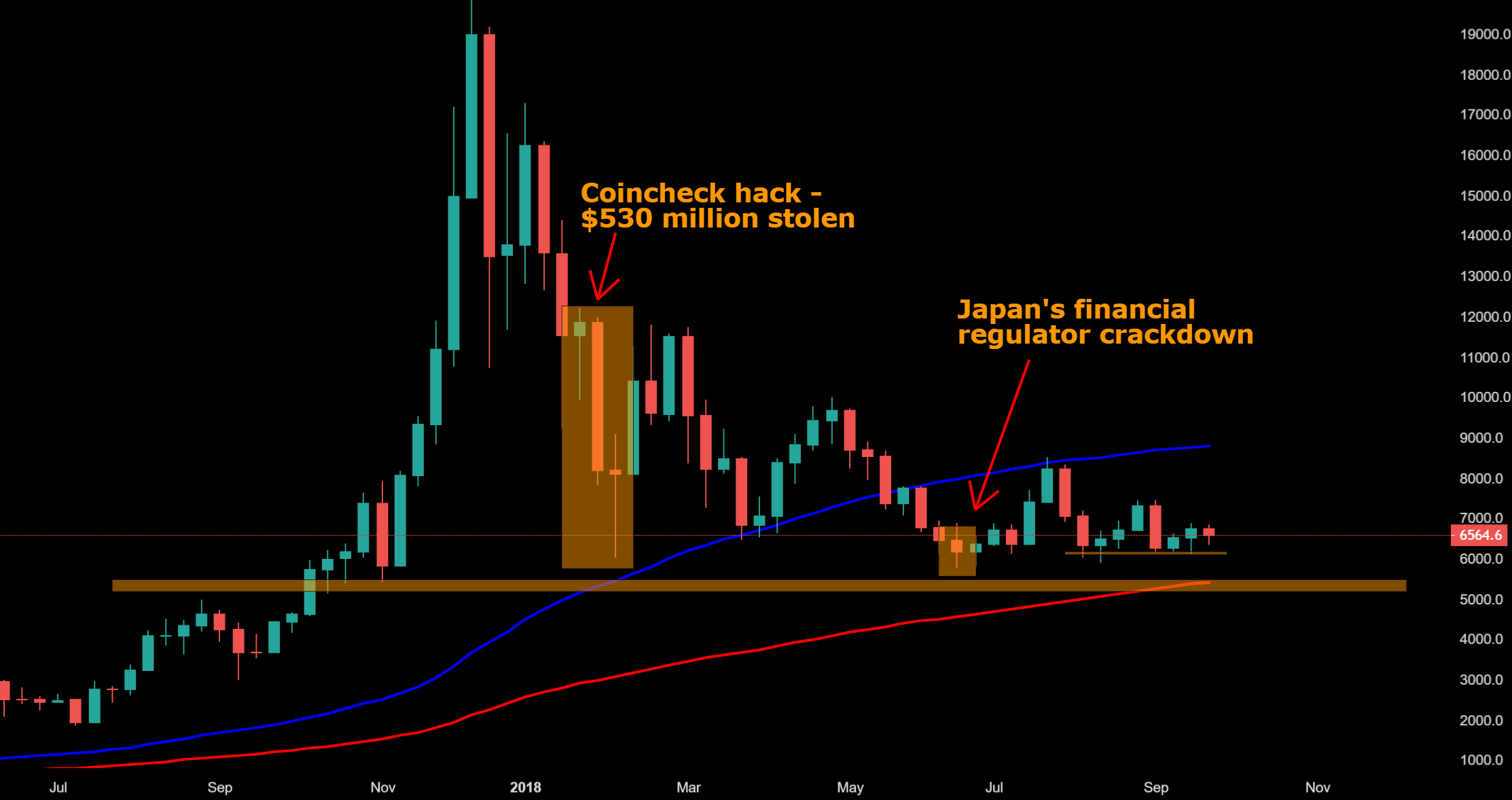

Last years the evolution went to crypto that has changed and will be changing the face of the industry forever. Although it is still early days. Coinbase has now over a 8 billion USD valuation.

The Present – Where we stand now

One of the fundamental challenges of the cryptocurrency market is to bring the Blockchain to the real world and really allow its use to the globalization of this industry. The crypto market has lost this path and it seems to me absolutely crucial to retrieve this focus back.

Likewise, crypto players are now all-based in the price of their tokens rather than the quality of such coin. Almost everything is about the price and that must change. A swift from the price and place it in the product is something less than key if we are to leverage the crypto market. If the current and future ICOs continue to attempt to attract investors by focusing on the price or the potential future rise in token’s price, they are doomed to failure.

On the other side of the coin, there are a large part of players that are trying to rise money with a potential good product and a nice white paper. However, this isn’t enough nowadays. You have to mix the traditional with the new. Before launching an ICO or even start a private sale you need a private placement to start things going. You can’t expect to raise money to pay your bills because It´s necessary money in advance. Launching an ICO is every time more expensive and a private placement will allow to get some money in advance but also allow institutional money to get in.

Of course, much of this is because of regulation. As we all know bad actors slink in the ICO space and ICOs are attracting fraudsters looking to fool would-be investors. Regulation will play an important role here and only in a safe environment will be possible to attract institutional investors and continue to attract retail investors.

The Future – Where we are heading to

The main goal of all players involved in and out of the crypto-world, including regulators, is to make them think that “none of this crypto isn’t for us,” because it is, for them and for everyone. In some way or another, all of them are ready to participate in this new world and if this current industry is able to organize itself and generate the necessary conditions, all of this will take place much more quickly. Personally, I think this process will most likely be fast than slow. Take countries like Switzerland, they have created regulatory environments extremely favorable and where nowadays it is possible to build an ecosystem with all the safety and regulation of a traditional industry.

The institutional side in this industry is virtually non-existent and the game changer will be when it arrives into this market. One of the key players for that to happen are exactly the exchanges. Almost all the most known and largest exchanges in the world are focusing on retail clients or small to medium traders. Projects focusing Institutional are necessary and It´s important to involve all the players like custodians, prime brokers, managers, funds administrators, clearing houses, etc on this. This industry can learn a lot from OTC markets for example.

This can be solved, by creating marketplaces on friendly jurisdictions. Those marketplaces would join all the different players allowing at the same time not only the development of the institutional business but also creating a safer environment for the retail exchanges.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.