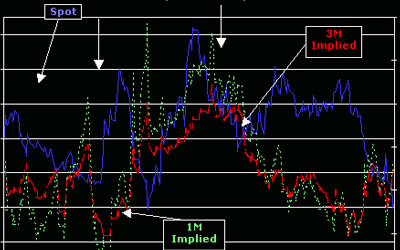

The euro plunged to fresh 12-year lows against the US dollar on Friday, as recent comments from European Central Bank President Mario Draghi continued to weigh on the common currency, while US nonfarm payrolls rose faster than forecast in February.

The EUR/USD declined for a third consecutive day, plunging 1.5 percent to 1.0865. The pair faces immediate support at 1.0844. On the upside, initial resistance is likely found at 1.1100.

The euro was under pressure after ECB President Mario Draghi announced the start date for bond purchases on Thursday. Draghi said the central bank will begin purchasing €60 billion worth of bonds next week in an effort to stimulate the Eurozone economy. The program is expected to last until September 2016 and will help boost inflation back toward the ECB’s target of just below 2 percent.

The ECB also announced on Thursday it expects the Eurozone economy to expand 1.5 percent this year, compared to previous forecasts calling for 1 percent. The Eurozone economy grew 0.9 percent annually in the fourth quarter, Eurostat confirmed on Friday. Compared to the third quarter, the economy expanded 0.3 percent.

Improving retail sales and business confidence headlined the modest pickup in economic activity in the fourth quarter. Germany, the currency region’s largest economy, grew 0.7 percent in the final three months of 2014, compared to just 0.1 percent in the third quarter.

German industrial production rose for a fifth consecutive month in January, a separate report revealed on Friday. Industrial output rose 0.6 percent in January and 0.9 percent over year-ago levels.

The US dollar was broadly supported on Friday after the Department of Labor said joblessness fell to a six-and-a-half year low in February, raising bets the Federal Reserve may still be open to a midyear rate hike. The unemployment rate fell to 5.5 percent in February from 5.7 percent the previous month, as employers added 295,000 nonfarm payrolls. Job creation has averaged 266,000 over the last year, enough to encourage the Federal Reserve to consider lifting interest rates in June.

The US dollar index, a weighted average of the dollar against a basket of trade nations’ currencies, climbed 1.23 percent to 97.56.

The dollar was also supported against the British pound, as the GBPUSD plunged 1.2 percent to 1.5069.

The dollar gained traction against the Japanese yen, as the USDJPY rose 0.8 percent to 1.2095 after hitting an intraday high of 1.2128.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading