Last week we saw continued volatility in the crypto space as the continued fallout from the FTX collapse sent shockwaves through the market. Meanwhile the USD managed to arrest the fall of the previous week. The DXY rose 0.5% to close around the 107 level as Fed members mostly remain hawkish on rates and the previous weeks large moves seem overdone.

Euro had a relatively quiet week as ECB speakers talked down excessive rate hikes and that eurozone rates would not peak as high as expected. This made the Euro lose on the week

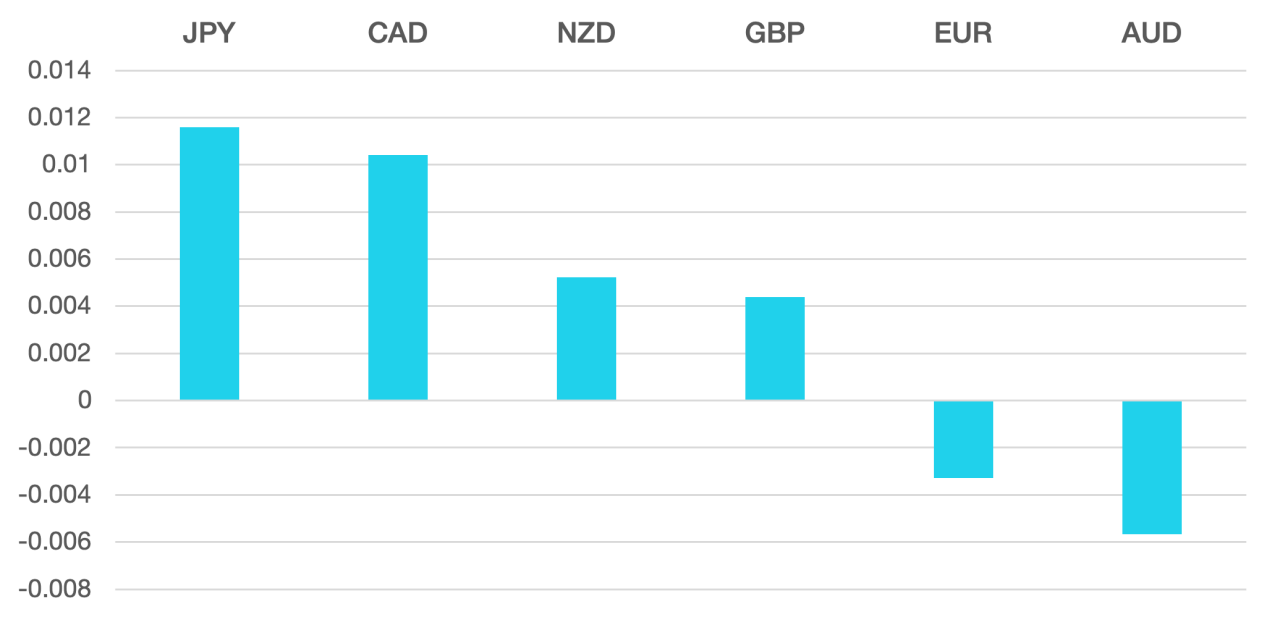

GBP continued its recent uptrend as the UK Government continue to undo the large amount of damage caused by Liz Truss. The GBP ended the week a quieter 0.4% higher vs the US Dollar.

Commodity currencies had a very poor week. Oil fell sharply on Chinas continued zero covid policy. As the market expectations of further lockdowns oil and other commodities moved lower. WTI fell almost 10% to close at around the $80 level.

The week ahead is still being driven by Fed comments and economic releases remain of high importance as any changing landscape data wise could lead the Fed to alter course.

In terms of data releases, we have the RBNZ interest rate decision and a broad range of PMI releases.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Crypto Markets Head the Volatility

first appeared on trademakers.

The post Cromwell FX Market View Crypto Markets Head the Volatility first appeared on JP Fund Services.

The post Cromwell FX Market View Crypto Markets Head the Volatility appeared first on JP Fund Services.