Last week the US CPI was released. The surprise was to the upside with the YoY did drop for the seventh month, but January’s decline was just 0.1% to 6.4%. This was higher than the market expectation and yields push higher on the back of the release.

The Euro had a quiet week as most Eurozone data came through in line. The week saw the single currency gain although very marginally vs the USD and GBP.

GBP was lower earlier in the week with misses from earnings and inflationary data but gained later in the week to close broadly unchanged vs the USD.

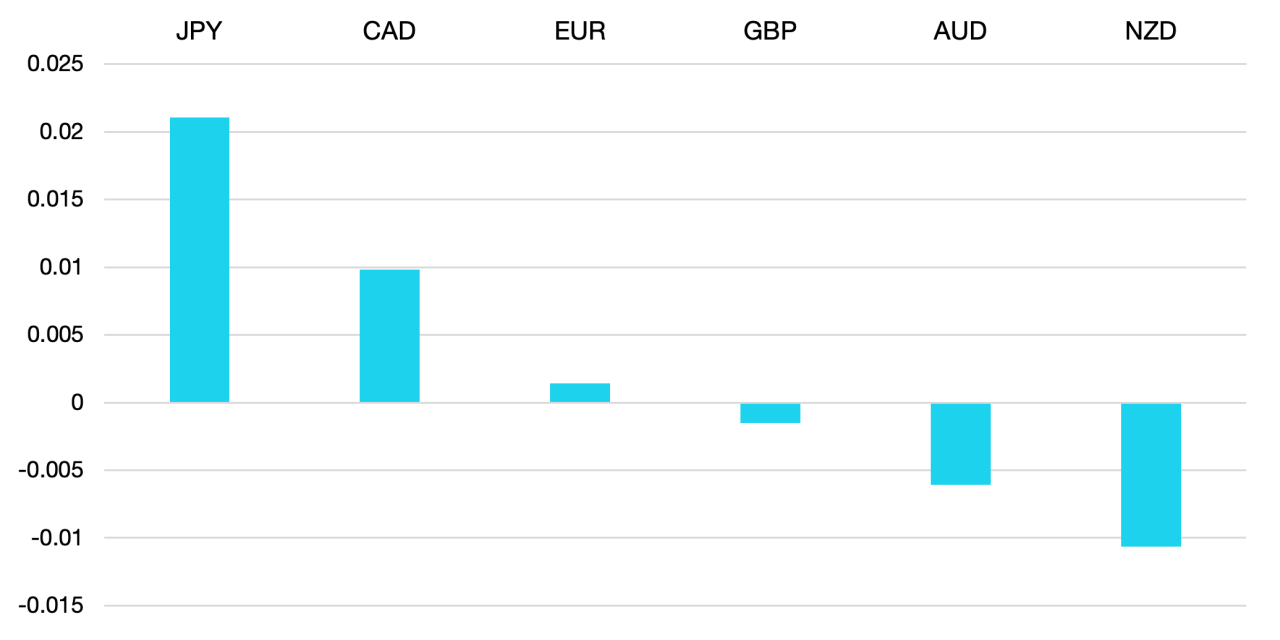

Commodity currencies suffered as post CPI yields rose and the US Dollar moved better. The AUD fell 0.5% while other commodity related currencies all dropped around 1%. The main loser was JPY losing around 2%.

Oil continued its wild ride following the previous +9% week. WTI this week fell 4% and it seems that Oil volatility is here to stay for the long term.

The week ahead has a large amount of data releases with GDP from the US and Germany along with the RBNZ rate decision.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

CPI Surprise

first appeared on trademakers.

The post Cromwell FX Market View CPI Surprise first appeared on JP Fund Services.

The post Cromwell FX Market View CPI Surprise appeared first on JP Fund Services.