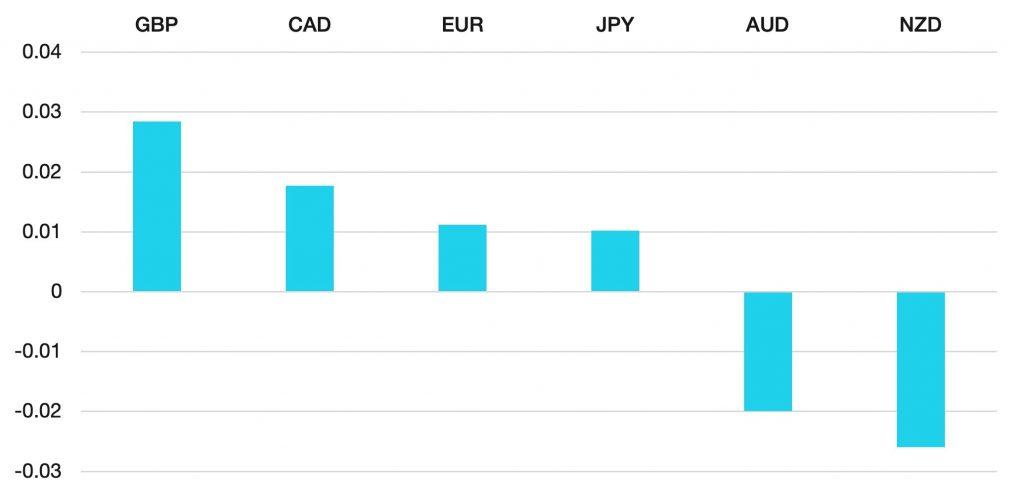

Last week we continued to see elevated levels of volatility. GBP came under initial selling pressure early in the week but also all currencies vs the USD were weak early in the week. The USD gave back gains later in the week despite upside surprise inflationary data. By the end of the week the DXY was down 0.8% at 112.17.

Euro made back the previous week’s losses as the ECB continue to sound more and more hawkish at each meeting. The market is now looking for a sizeable rate rise at the next meeting. The single currency rallied 1% during the week.

GBP was under immense pressure. The beginning of the week saw GBP drop to 1.0350 a new low vs the Greenaback. Market speculation was rife as the it began pricing in emergency rate rises. In the end an announcement from the BoE that it was looking to buy Gilts was enough to turn the tide (for now) Sterling rallied throughout the week closing above 1.11. Despite this it is still difficult to be bullish the GBP in the medium term

Commodity currencies once again continued their downward move as risk assets remain under pressure. The week saw both AUD and NZD fall around 2%.

Oil prices found support during the week after the last few weeks of moving lower. WTI rose 0.5% to close at $79.67.

The week ahead could see continued levels of volatility. The BoE move last week shows markets are vulnerable. Data wise we have a week of PMI and inflation data releases.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

BOE Intervenes

first appeared on trademakers.

The post Cromwell FX Market View BOE Intervenes first appeared on JP Fund Services.

The post Cromwell FX Market View BOE Intervenes appeared first on JP Fund Services.