In spite of projections of greater demand and growing popularity for energy generation, spot natural gas prices remain not far from low levels last seen in the late 1990s. Even though both supply and demand have fallen on an annualized basis, the drop in demand has greatly outpaced supply, leading to an imbalance. Adding to the overarching weakness in prices is the fact that working gas in storage continues to rise, climbing well past the 5-year average and typical seasonal levels. Even though production has fallen modestly over the last year, output still remains robust, adding to the downside pressures facing natural gas as warmer weather conditions prevail and the summer months rapidly approach. If the global economy continues to struggle, it could spell another round of imminent losses for prices as they fight to regain footing above $2.000 per MMBtu.

Market Fails to Find Equilibrium

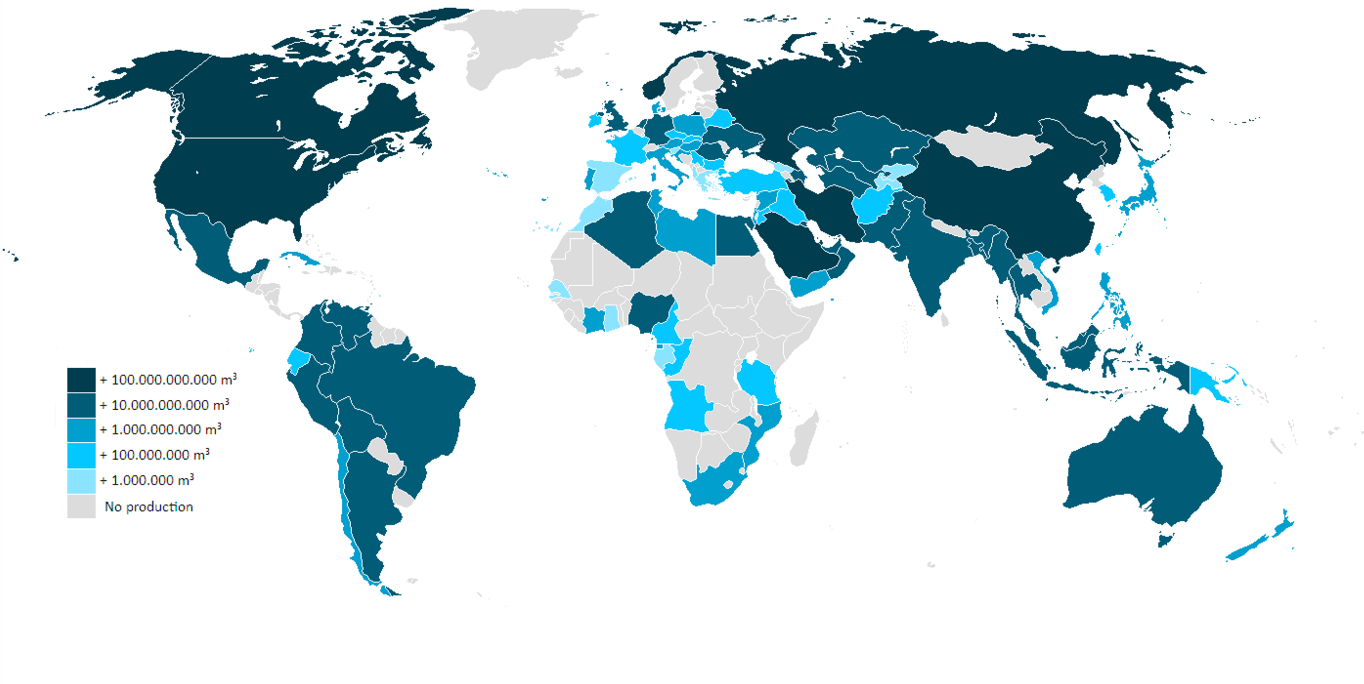

The wide disparity between supply and demand in the natural gas market continues to be a forceful factor weighing down prices in the interim. Despite the approaching ability to sell natural gas production internationally via liquefied natural gas export terminals that are slowly coming online, US gas production remains mainly subject to domestic conditions. According to the latest data made available by the Energy Information Administration, output for the week ending the 18rd of March rose by 1.35%, helped in part by a rising active rig count. In the latest Baker Hughes report, active rigs rose by 3 to 92, even though the total has plunged by -60.52% over the last year. On an annualized basis, production has fallen by a marginal -0.96%, widely outpaced by the -3.30% drop in demand which has sent stockpiled working gas levels to the highest on record for this time of year.

Even though demand has picked up in other areas as consumer gas consumption has fallen, it has not been enough to step out of the long shadow cast by existing production levels. According to the Short-Term Energy Outlook from the EIA, natural gas is even expected to overtake coal for power generation in the United States for 2016, accounting for 33.30% of total generated power in 2016 amid a period of prolonged price weakness. Even though the two means of power generation are expected to be equivalent in 2017, especially should natural gas prices begin to rebound from current levels, any near-term recovery is unlikely absent falling production and substantial improvements in end-user demand. The end of seasonal conditions that normally contribute to higher prices will also be a factor that weighs on prices as warmer weather means less demand to meet heating needs.

Technically Speaking

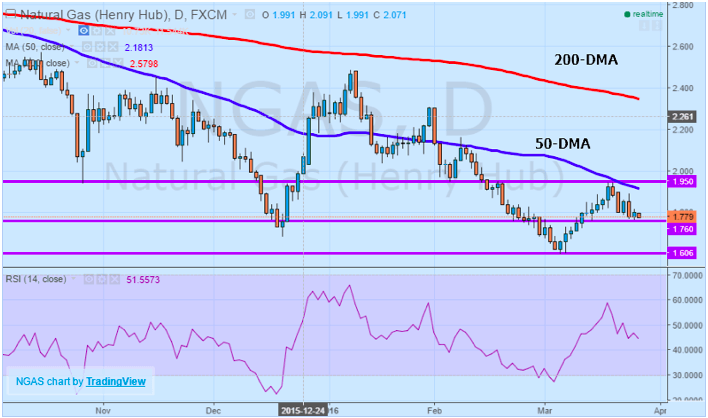

On a performance basis, natural gas remains mired in a bear market with prices falling over -38.62% on an annualized basis and -23.43% year-to-date alone. Now that many of the conditions that supported demand and prices over the last few months are about to absent considering improving weather conditions and rising domestic production, US natural gas prices are once again likely to tumble lower. From a technical perspective, natural gas prices are currently sitting at a very interesting potential pivot point and support at $1.760 per MMBtu. A break below this key level paves the way towards the latest 52-week lows at $1.606 reached earlier in the month, marking the lowest levels in over 17-years. In support of continued downward momentum in natural gas prices are both the medium and longer-term 50 and 200-day moving averages with both trending lower above current prices, acting as resistance to any sustained bounced in prices.

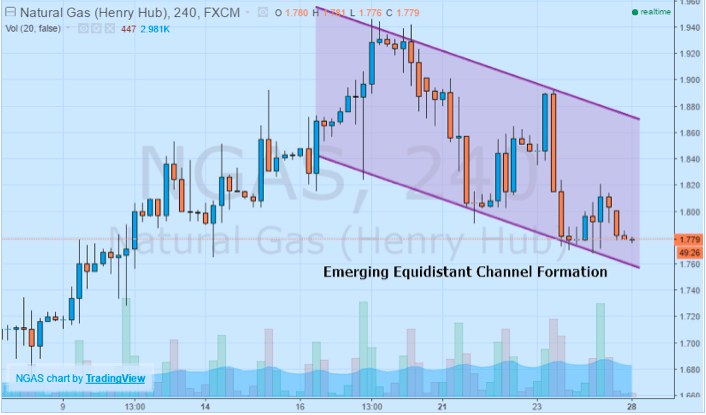

On a shorter-term basis, the emergence of a downward trending equidistant channel formation has added to the predominantly bearish bias in natural gas prices. Although nearing the bottom of the channel which is not necessarily an ideal entry point to take advantage of renewed price weakness, a bounce in prices towards the upper channel line should be viewed as an optimal opportunity to establish positions expecting further losses in the gas benchmark. However, should natural gas manage to record a candlestick close above the upper channel line it could indicate a channel-based breakout to the upside.Furthermore, a move above resistance sitting at $1.950 could be the beginning of a reversal in the prevailing downtrend and be the catalyst for a sustained correction higher in prices back towards the key $2.000 MMBtu psychological level. Nevertheless, the predominant bearish bias remains intact in the event of no change in fundamental conditions.

Unrelenting Pressure

Taken from the perspective of prevailing fundamental and technical circumstances, the upside potential in natural gas prices is very limited over the near-term with rising potential for losses to spiral lower once more. After a tremendous drop in the last year and a supply-demand imbalance that remains woefully intact, alleviation of price pressures is not imminent. Although there is some room for a technical correction higher in prices over the short-term, on a medium-to-long term basis, this upward momentum should strictly be taken as an invitation to establish positions expecting prices to drop further, reaching back towards multi-year lows.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading