In spite of supply disruptions and inventory drawdowns that have raised speculation that record American oil inventories are going to ease further, oil prices are pulling back after giving up ground for nearly a week. Concerns about an end to the ongoing production interruptions combined with falling demand from key buyers such as China and rising Middle East production could once again derail the fragile equilibrium that briefly drove prices above $50.00 per barrel. Although the correction in prices could be just a pullback before a resumption of the uptrend, there are growing signs that the oversupply conditions that led to the rout in oil prices over the last two years might be resurgent even with higher seasonal demand.

Disruptions to Abate

One of the key reasons that supply fell so sharply over the past few weeks was numerous supply disruptions across the globe. Between disorder in the Niger Delta, fighting in Libya, and wildfires in Alberta, production was cut by millions of barrels per day, helping to offset higher production in other regions. Iraqi and Saudi output hitting new heights combined with Russian exports overtaking Saudi Arabia have all contributed to surpluses across the globe, heightening the risk of a renewed round of price cuts as key suppliers work to maintain market share. However, the factors that drove the disruptions across the globe are now in the early stages of reversing. With production from Alberta expected to come back online towards the end of the month and marginal production returning thanks to higher prices, the current equilibrium in prices may not last much longer.

Although the US summer driving season is in full swing, helping to alleviate swelling onshore inventories, there are other signs that demand growth globally might not meet expectations. Despite US inventories reportedly falling 933,000 barrels last week after drawing down for four straight weeks, this is mainly a seasonal development. With air travel looking less safe and more motorists taking to the roads for summer holidays, gasoline demand is in high gear, with storage levels plunging by 2.625 million barrels last week. However, US demand is only one component, with the second largest consumer, China, seeing demand growth slow rapidly. After record consumption in April, Chinese oil demand fell in May, sliding -0.80% year over year. While rising demand in India is offsetting the weakness in China to a degree, should oil production ramp back up in the second half of the year as disruptions abate, prices could readily retreat.

Technically Speaking

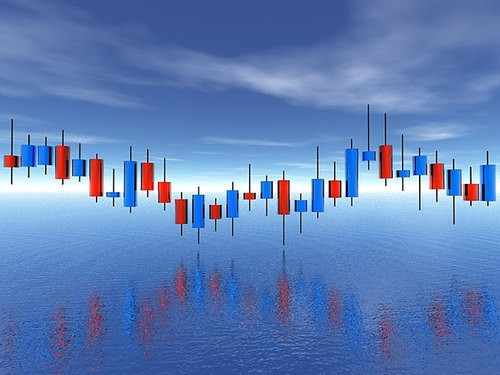

After a tremendous upswing that briefly saw crude oil prices rally above $50.00 per barrel, prices are once again on the retreat despite the numerous factors that have created a temporary equilibrium between supply and demand. One of the biggest recent developments is the breakout from a bullish equidistant channel formation that is signaling more room for losses in the West Texas Intermediate benchmark. The candlestick close below the lower channel line is indicative of a channel-based breakout which could see prices pullback to the mid-$40.00s per barrel. Although higher volumes would traditionally accompany the breakout, they have yet to materialize, indicating that it might be too early to call this recent move lower an actual reversal. However, there are other indicators that are suggesting further room to fall like the relative strength index which is still trending lower after reaching overbought territory earlier in the month.

If prices do continue to fall from current levels, any correction is likely to meet stiff support on the downside from the moving averages which are trending higher. Although the 50-day moving average crossing over the 200-day moving average back in May could be viewed as bullish, it is not a “golden cross” which is typically accompanied by substantial momentum higher. Nevertheless, falling prices will likely encounter support at the upward trending 50-day moving average around $45.80-$46.00. Additionally, the stochastic oscillator approaching the bottom of the range could add to the near-term upside momentum, especially if the recent %K line crosses over the %D line to the upside, generating a strong upside signal. With crude oil trending near the lower Bollinger band after losing ground in four of the last five sessions, a move higher towards the median line is not unfeasible.

Going Forward

The main developments that will impact crude oil pricing going forward remains the political standoff in the Niger Delta combined with the production outages in Canada and Libya that have enabled the energy product to reach a temporary equilibrium that has bolstered prices. Additionally, slowing demand from China combined with rising output from Gulf nations will potentially renew conditions that drove oil prices down to multi-year lows earlier in 2016. Although near-term prices are likely to remain elevated, rising production and a resolution to the Nigerian hostilities and Canadian production disruptions could quickly throw the energy industry back into turmoil, sending crude oil back to the low $40.00s and below over the coming months.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading