Nasdaq 100 Futures At a Turning Point

After reaching new record heights that exceeded those of the late 90s technology bubble, the Nasdaq 100 futures epic ascent looks increasingly ready for a significant pullback and correction as falling volumes and volatility act as a precursor for a change in momentum. Considering the challenging earnings environment and heavy technology weighting of the Nasdaq 100 futures, risks are currently more skewed to the downside than the upside. Furthermore, Federal Reserve officials warning about the complacency of financial markets in appropriately judging the path of interest rates could be a looming factor that crushes valuations. Should rates rise before the end of the year, the party for stocks might be over. Taken together, all these factors in tandem could easily force a rapid correction in Nasdaq 100 futures despite the potential for more modest upside near-term.

Ongoing Earnings Contraction and Increased Hedging

For US equities, the last two years have been particularly challenging as major corporations and multinationals face off against slipping earnings growth. For the last 6 quarters, earnings for the S&P 500 have seen the pace of gains steadily falling, with no quarter of above double digit growth since back in 2015. Besides underscoring the challenges that lie ahead for company earnings, it also makes the most recent all-time highs in Nasdaq 100 futures even harder to swallow considering the valuation is not backed up by fundamentals.

Furthermore, the concentration in the technology sector in particular may be a troublesome factor hurting the index’s outlook. Considering the sector accounts for 52.89% of the entire index’s weighting, any significant weakness in forward guidance, like the poor revenue forecasts provided by Apple, will hurt the broader outlook.

While Nasdaq futures have progressively climbed despite the raft of negative outlook, it has only further raised the risks which have been picked up on by many notable names. Aside from sell-side investment banks turning more bearish on the outlook and the latest bull market proving amongst the most unloved in history, growing pessimistic sentiment has been echoed by increased hedging activity. When major asset managers are lining up hedges against a severe market downturn, it is smart to pay attention.

Even though portfolio managers talking their books on television segments are typically cases of “do as I say, not as I do,” legendary activist Carl Icahn and acclaimed investor George Soros are busy putting their money where their mouths are by taking out protection against a serious pullback in valuations.

Aside from fears about a market crash, is the growing risk of a Federal Reserve rate hike in the coming months. Although the Central Bank has maintained that it will be data dependent when it comes to making any decision about raising interest rates, comments from key members underscore the heightened probability of another rate hike before year end.

Any such action could seriously undermine the valuations of equities, especially if the dollar starts rising. Furthermore, the share buyback gimmick practiced by these companies over the last few years when rates stood at record lows will disappear, hurting upside potential in shares. Moreover, rising rates will likely lead investors to reallocate towards assets with the perception of less risk, specifically bonds, hurting the Nasdaq’s valuation as portfolios are rebalanced to reflect changing realities.

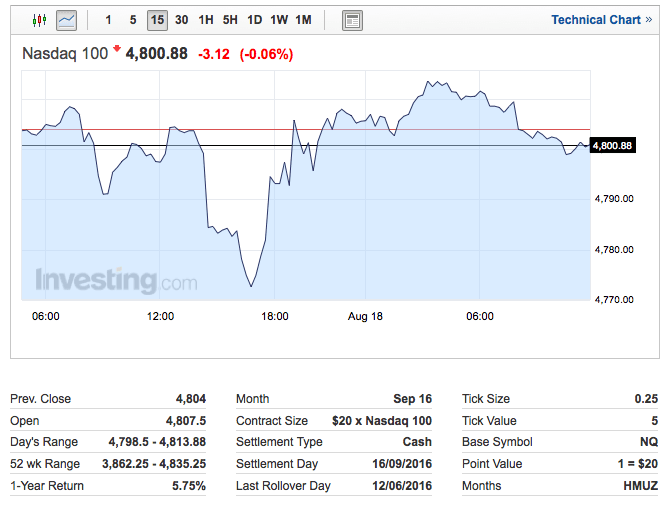

Technically Speaking

In the case of the current bull market in Nasdaq 100 futures, indicators that are particularly suggestive of a coming reversal in the prevailing uptrend are volume and volatility. When both are falling amid new highs, it suggests that momentum is also fading, traditionally viewed as a precursor to changing direction. While the moving averages are supportive of additional upside in the Nasdaq 100, especially after the bullish crossover when the 50-day moving average crossed the 200-day moving average to the upside, the Relative Strength Index paints a different picture.

With the RSI retreating from oversold levels reached earlier in the week above 70.0, the stage might be set for an even deeper correction. The support level to watch near-term is 4700.00 before testing the 50 and 200-day moving averages which are also acting as support. Any further decline will likely see a retest of the post-Brexit lows.

Looking Ahead

Upon further review of the Nasdaq 100, it is clear that risks remain skewed to the downside over the medium-term. With little in the way of positive catalysts for further upside, the risks of establishing bullish positions to capture an extra 2.00-5.00% might be accompanied by the risk of a 15.00-20.00% correction. Between falling earnings growth, increasingly bearish sentiment, rising hedging, and the possibility of a rate hike before the end of the year, optimism is likely to remain absent over the coming months.

When reviewing the fundamental picture in tandem with the technical factors underlying the current price action, falling volumes and volatility are indicative of a coming shift in momentum. Whether or not renewed price momentum results in a downside breakout remains to be seen, however, considering the lack of upside motivation, Nasdaq 100 futures may be poised for a steep technical pullback.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading