Bitcoin mining revenue dropped by $900 million in Q1 2025, falling to $3.86 billion, marking an 18% year-over-year decline according to data presented by CryptoPresales.com. This decrease is attributed to lower Bitcoin prices, reduced network activity, and smaller transaction fees. Major mining companies like Bitdeer and Core Scientific have seen significant stock value declines, with Bitdeer experiencing a 52% loss. The slowdown underscores the sector’s vulnerability to market fluctuations and poses challenges for miners soon.

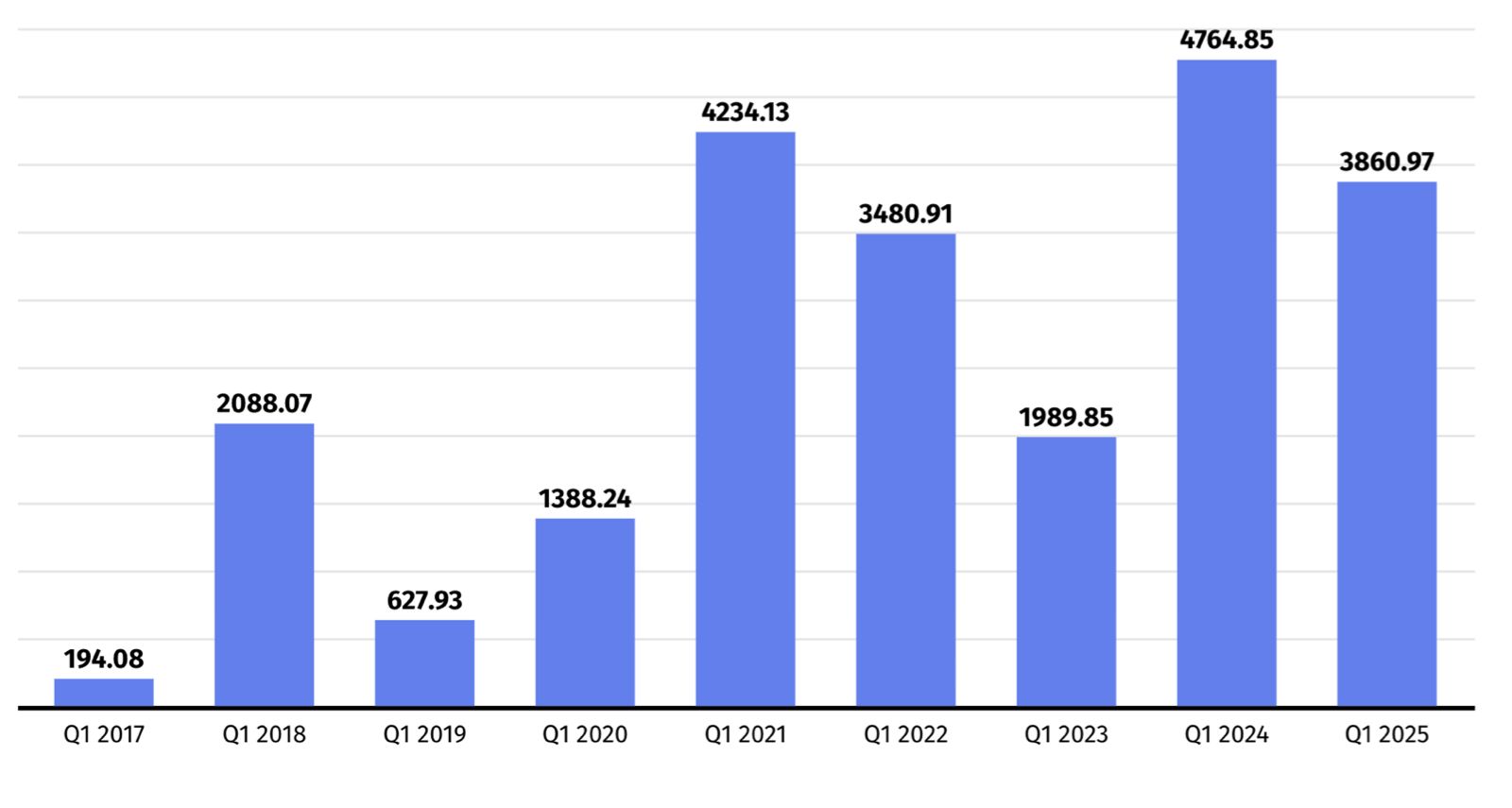

The crypto market slowdown has had a major impact on Bitcoin miners, with earnings taking a hit due to declining Bitcoin prices, lower network activity, and reduced transaction fees. According to the latest data from CryptoPresales.com, Bitcoin miners in Q1 2025 generated $3.86 billion, reflecting a significant year-over-year decline of $900 million. This drop represents a substantial 18% decrease in miner revenue, pushing it back to levels seen in 2022.

Bitcoin miners’ revenue is largely influenced by the price of Bitcoin and transaction fees. When Bitcoin prices remain low or fall, as they did during early 2025, miners earn less for each block added to the blockchain.

As miners are typically rewarded in Bitcoin, a decrease in its price reduces the dollar value of the rewards, even when the amount of mined Bitcoin remains the same. In addition, reduced market activity and lower transaction volumes during a market slowdown lead to a further reduction in transaction fees, compounding the financial challenges faced by miners.

Revenue slips back to 2022 levels

Statistical data from Statista and Coin Metrics reveal the extent of the decline. While $3.86 billion in earnings is a noteworthy sum, it marks an 18% plunge compared to the previous year. This double-digit decrease has pushed mining revenue back to 2022 levels, when miners earned approximately $3.4 billion in Q1, also experiencing a 17% drop year-on-year.

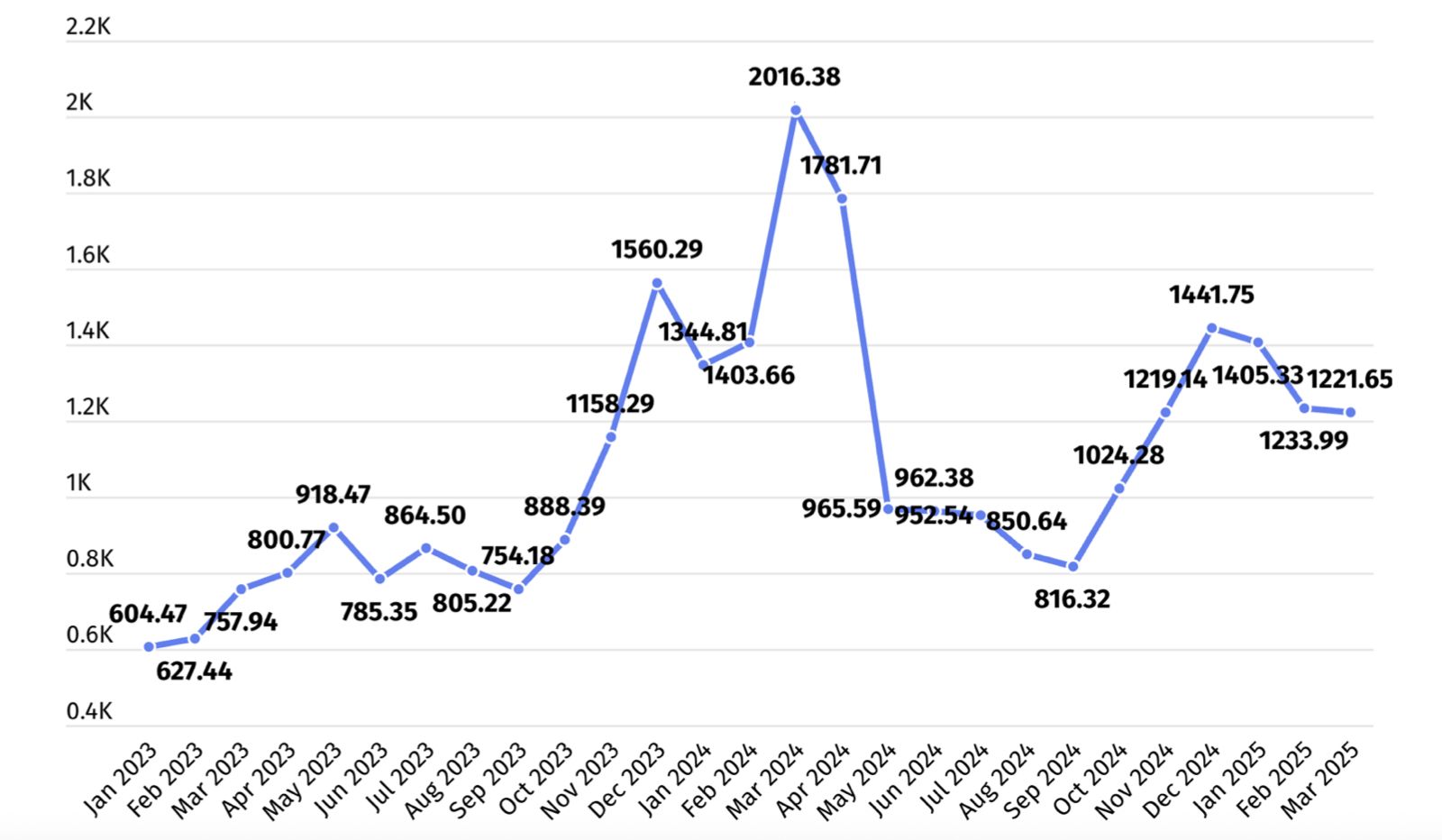

The average monthly revenue for Bitcoin miners also saw a notable decrease of 17% during Q1 2025. In contrast to the first quarter of 2024, when miners averaged $1.55 billion per month—including a peak of over $2 billion in March—the monthly average for Q1 2025 dropped to $1.28 billion, representing a loss of $270 million in monthly revenue.

The struggles of major Bitcoin mining companies

Bitcoin’s price volatility and the overall downturn in market activity have severely impacted the stock value of the largest crypto mining companies. The combined market capitalisation of the five largest players in the sector—Marathon Digital Holdings, Riot Blockchain, CleanSpark, Core Scientific, and Bitdeer Technologies Group—was valued at $22.2 billion in January 2025. However, by April, this figure had fallen to $14.7 billion, marking a significant 36% drop over the course of just three months.

Among these companies, Bitdeer Technologies Group has experienced the most considerable loss. The Singapore-based mining firm saw its market cap plunge by 52%, dropping from $4.3 billion to just over $2 billion. Core Scientific and Riot Blockchain also faced steep declines, with their stock values decreasing by approximately 35%.

Core Scientific lost $2.7 billion in market value, while Riot Blockchain saw a $2.5 billion reduction. CleanSpark, on the other hand, experienced the smallest drop in market cap, at 16%.

The combination of lower Bitcoin prices, reduced transaction fees, and a slowdown in market activity presents a challenging landscape for Bitcoin miners. While the sector still generates significant revenue, the current market conditions highlight the vulnerability of miners to external economic factors such as cryptocurrency price fluctuations and network congestion. As the situation continues to evolve, Bitcoin miners may need to adapt their strategies to mitigate the effects of these challenges.

For now, the decline in revenue and stock value emphasises the impact of market volatility on the crypto mining sector. In the coming months, it remains to be seen how miners will respond to these challenges and whether any recovery will occur as market conditions change.

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.