Funderbeam A Powerful Fast Growing Blockchain Powered NASDAQ for Startups Trading Platform by Skype co-founder Jaan Tallinn.

As Blockchain continues gaining momentum and affecting anything in the financial industry it starts as well touching deep the investing and trading industry. Skype visionaire co-founder Jaan Tallinn and Funderbeam co-founder, Urmas Peiker, launched this innovative data driven trading and investing platform for startups, affirming on that it is “the first time in history where startup investments are being traded using blockchain technology.”

Jim Schneider, a research analyst in Goldman Sachs Research suggested / affirmed recently that “[With Blockchain], there’s potential for the disruption of middlemen, as well as reduction in the billions of dollars in administrative costs that exist today.” So how can Blockchain disrupt the trading and investing industry? Trading and investing is more and more dependent of the use of tech and fintech is its bigger driver.

Funderbeam seems to be on the right direction to become a solid investment and trading platforms for early stage companies / startups with according to their website over $388.97bn Disclosed funding running through its network.

Founded by Jaan Tallinn the famous visionary Estonian programmer who participated in the development of Skype in 2002 and FastTrack/Kazaa, the revolutionary inception of file-sharing application, in 2000 the platform has the names and tech knowledge behind them.

Funderbeam’s goal and DNA is to become a primary and secondary market for early-stage startup investments providing easy delivery and access of growth capital both for investors and startups, a sort of data driven, and data visualisation social media blockchain powered NASDAQ for the fast growing startup world.

With 156,936 Startup profiles the platform is already a powerful asset for investors and startup for trading and investing in small early stage companies, a sort of equity platform for startups, a sort of, using again the comparison, an incipient NASDAQ platform for early stage companies / startups with big data, social media advanced features. According to the founders the objective is to change the game for early stage investors, making it their own choice as to how long they want to hold on to their investments.

By using the Bitcoin’s blockchain technology to “tokenize” the source of investments, Funderbeam wants to make the presentment of trading secure, efficient, open and transparent.

One of the key areas Funderbeam offers is a network map offers that shows you who’s who and who’s connected to whom in the startup and investor world. With this investors and startups can see the stunning hidden network that drives the industry.

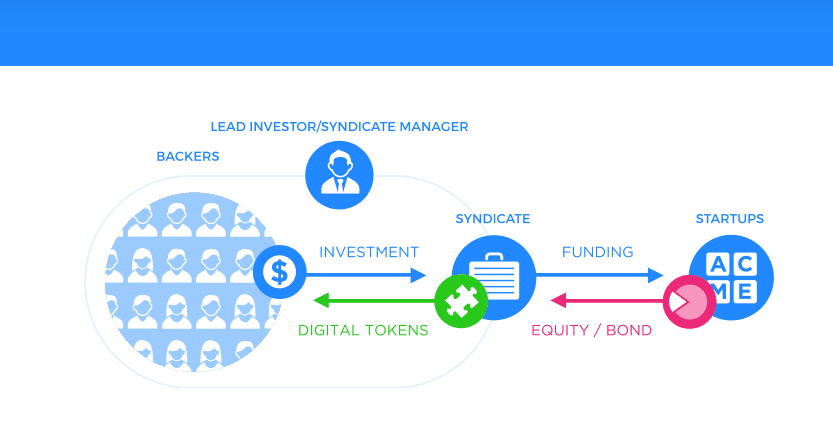

Through its operations each digital token represents its owner’s rights in an investment syndicate. Funderbeam methodology and process uses the syndicate model to pool investors’ funds, adding just one investor (the format of a syndicate lead) to the startup’s cap table.

Using the platforms, startups can spend less time fundraising and focus on growing the company and its business. Syndicated funding, similar to crowdfunding, brings startups the money and expertise of lead investors, and the pooled capital of passive backers but with the effective transparency of a full trading platform. With Funderbeam founders can raise larger rounds while gaining evangelists, promoting their company, and reaching who has an interest in the company’s success.

Other important areas and strengths of this project is the fact that Funderbeam covers all steps in the investment life-cycle, from the hard initial screening, offering a global database of startups and investors to the syndicate creation, management and exit for a business. Each step takes place directly on the platform in a full cycle driven by data, competitor analysis and mapping ecosystem and business model and investors network.

According to the platform the outcome is a more effective investing and trading process for everyone. Funderbeam has also a suite of standalone online and social media tools for startup discovery and analysis. Example are its display of more than a dozen powerful search filters, deep profiles, advanced competitor mapping, startup and investor tracking, and predictive analytics are available for a low monthly subscription.

Of course the challenge for this project and similar is the capacity of adoption and scale like in any advances new system or technology. But this seems to be already moving with a solid footprint of users / companies, as the platform has data intelligence on over 180,000 startups and investors

“Investing in the future will be digital, always on, and transparent. As will companies,” said on the vision of the project Kaidi Ruusalepp, Funderbeam’s CEO and co-founder and former CEO of Nasdaq Estonia. “I’m excited to see us take the first steps toward that future.”

The first two companies to be listed on the new exchange were two Estonian startups, Shipitwise and SportID after that the platform fast grow and now is in a pole position to achieve a solid number and user base. These initial companies both successfully conducted crowdfunding campaigns on Funderbeam first.

Funderbeam is currently working with companies in the U.K., Germany, Finland and worldwide to expand its service but wants to conduct a trial run with the startups to ensure a smooth operation.

Well known venture capitalist Tim Draper said when Funderbeam first launched: “I love what they’re doing. You know, the existing public market is not working and Funderbeam is doing something about it.”

At the original announcement, CEO Ruusalepp predicted the growing importance of blockchain technology in the financial world:

“Blockchains are going to do for the financial sector what the internet did for daily life as we know it. Stock exchanges have many intermediaries between the money and the company. Securities depositories, central banks, central counterparties, brokers, dealers and account operators. The blockchain is taking the role of some of these intermediaries. So it’s making the process easier, cheaper and cross-border.”

Over the last year, Funderbeam has been fast growing and helping angel investors and entrepreneurs discover, benchmark and analyze startups, using data from services such as AngelList and CrunchBase.

Funderbeam has raised $2 million from investors to date and has an extensive data platform with information on more than 150,000 startups. The company’s website includes a detailed listing of new companies looking for funding, including how much has been raised to date as well as their funding goals and timeline.

Funderbeam plans to take a 3 percent commission from successful ventures and may introduce trading fees in the future.

Nasdaq has led the way in developing blockchain technology for trading platforms with its Linq project and is currently working with Estonia’s Tallinn Stock Exchange. Other exchanges developing or looking at applying blockchain include Deutsche Borse and the Australian Securities Exchange.

If you are an investor or startup you can register here:

http://blog.funderbeam.com/how-to-sign-up-on-funderbeam/

Bellow their entry in Crunchbase:

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.