Jared Broad CEO and Founder QuantConnect is an entrepreneur that has been pushing innovation solutions to help tackle dire humanitarian, business, finance and trading problems. A graduate of the Biomedical Engineering from University of Auckland, New Zealand, Jared from the early age of 16, when he started trading, is an innovative and entrepreneurial spirit, developing initial cutting edge medical technology and after launching a software development consultancy while still in school.

In early-2009 during the pick of the financial crisis and worldwide economic recession Jared and his then partner, Cesar Russo, decided to start ImplementingPartners.com (IPC). The IPC startup venture was created as an international humanitarian consulting company, which was working to fix the inefficiencies and delays chronic in worldwide NGO work. In less than a year, the two partners had a million-dollar operation on their hands. After he completed his last IPC contract in Chile, Jared decided it was time to seek a more creative challenge.

Jared returned to his training and soon began working on one of his passions a new financial algorithm. He knew that he could combine both his drive to help raise money for humanitarian efforts and innovating in technology, algorithm finance and trading. Starting from scratch, he gathered financial data, built an algorithm simulator, connected to an order processor and launched a small hedge fund called Stocktrack.org. He began initially trading on $50,000 capital raised from family and friends. It was soon trading up to $250,000 per day. For 18 months, the fund was automated and traded beating the market by 15% during volatile times.

In 2011, he found something more ambitious QuantConnect, a pivot startup from Stocktrack.org. The goal: take mainstream this algorithm technology applying open data sources to finance and trading and offering a powerful cloud customer to an emerging community of quantum algorithm engineers, developers traders.

In 2011-2012, Jared also won a Start Up Chile grant, was invited to the TEDx Wall Street event and Battle of the Quants in New York. Independent, innovative, driven, and a humanitarian, Jared Broad encompasses the qualities every entrepreneur strives to attain and the new image, prototype of the new Finance, trading and Technology leaders.

Forex Think interviewed him about his background and new innovative disruption algorithm trading venture QuantConnect.

Forex Think: Can you tell us about you and your background?

Jared Broad: I grew up in New Zealand and then left to explore the world, worked as a professional engineer, then in humanitarian work, and for the last 4 years in startups and technology. In 2008 I started designing algorithmic trading strategies full time, and then in 2009 was executing them with capital raised from friends.

What is your education background?

I studied Biomedical Engineering from University of Auckland, New Zealand. But I’ve been trading since I was 16. Quant modelling is much like Biomedical Engineering – lots of math and coding. I taught myself finance concepts and learnt about risk control after losing a lot of money on bad strategies when I first started out.

Can you tell us about quantconnect.com? What are the motivations behind the launch of quantconnect.com?

We are democratizing algorithmic trading by giving engineers access to free financial data, powerful cloud computing and order execution. When we find a good strategy we help them shortcut to raising millions in investment capital.

After two years designing models, and then live trading I encountered all the problems a quant encounters trying to set up trading independently. It is difficult getting good quality historical data, setting up live order routing execution and raising capital once you have a good strategy. Then when you have all this setup a back-test can take hours because of the sheer volume of data involved! QuantConnect was born to overcome these barriers and enable any engineer to quickly design and trade a strategy using the best tools possible.

How do you differentiate between a general algorithm trading and quantconnect.com?

We’re trying to bring concepts of open data, and community to an industry which has deeply entrenched data providers and highly secretive strategy development. We believe these old models will not last, and we want to usher in the future of decentralized finance. Currently algorithmic trading is the coveted toy of the super wealthy; our long term goal is to bring algorithmic trading to the mainstream investor, so they can be empowered with powerful investment strategies.

How is quantconnect.com changing the face of algorithm trading? and what are the FinTech innovation differentiators behind that?

By providing a platform with unlimited free tick-data we’re opening up what would typically cost $50,000-$100,000. This data is several terabytes in size, so we’ve built an incredibly powerful backtesting environment utilizing hundreds of computers in parallel to complete backtests in 1-2 minutes. This is a revolutionary difference to options currently available.

Can you tell us about the cloud computing offerings of Quantconnect.com?

Our cloud cluster analyses algorithm the engineers develop. They simply request the data they’d like, and the time period they need and the algorithm returns the resulting equity curve from the code you’ve entered. We manage all the cloud computing infrastructure and data costs, enabling you to focus on writing a strategy to earn returns.

Quantconnect.com is a solution for algorithm traders and a community, how do you describe this?

Trouble happens in the markets when highly correlated strategies make the same bad decisions. This effect is enhanced when there is only a select few individuals designing the strategies. QuantConnect enables incredible diversity in the markets, and brings millions of minds with millions of different ideas on the markets together to design new and creative strategies which hopefully will keep the markets diverse.

How do you see the future of algorithmic trading?

As society becomes more open and trusting of cloud service providers I can see all of finance becoming a decentralized service. Wikipedia enabled a decentralized body of contributors to create the most powerful learning resource on the internet, applying this model to finance may take a little longer but I hope to create a global network of engineers designing millions of diverse strategies, and helping investors across the world earn better returns.

Why quantic trading?

Without the discipline of algorithmic trading retail investors don’t stand a chance in today’s markets. If we want to truly democratize finance, decentralize strategy development and empower retail investors it must be done with automated, scalable, repeatable techniques.

In today’s markets traditional techniques such as technical analysis, candlestick patterns and buy-hold strategies don’t cut it anymore. Well designed quantitative strategies are statistically controlled, operating within tight parameters to reduce risk.

Quantconnect.com is leveraging Trading to a new level, how do you see that?

I believe we’re enabling strategy development and iteration at rates never seen before. In 15 minutes you could design 15 different strategies and test the variables in each one. By giving access to the data we are opening algorithmic trading up to millions of users where its currently limited to about 10,000 people around the world.

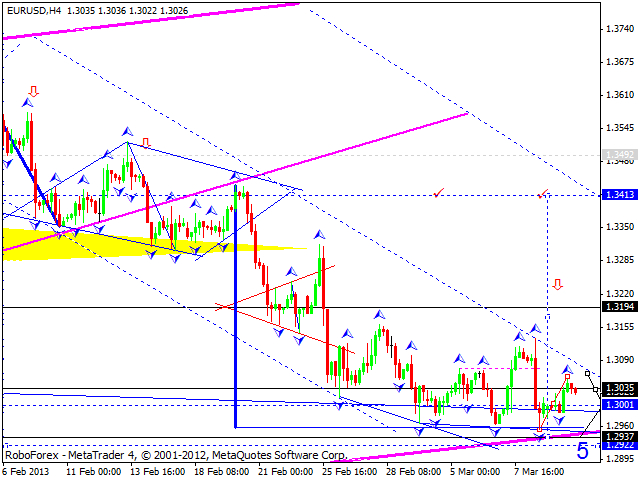

How do you see Quantconnect.com offerings in comparison with other algorithm trading, such as MT4?

MT4 is great for strategies with the lowest resolution data of a minute, for investments over weeks to months.

What are the main considerations about the algorithm Trading in the present shift landscape?

With reduced costs of trading, data and cloud computing there’s never been a better time for algorithmic trading. New laws are being formed to prevent misuse of the markets

How do you see social trading?

Social trading is a great evolution of the traditional fund manager.

How do you see the challenges of Finance and Tech industry?

Balancing legislation and freedoms will be challenging for a new frontier. Open finance, and decentralized strategy generation is good for the markets but at the same time we must protect general investors from extortion and greed. Web models are modernizing finance and so its a little like the wild west at the moment, and thats not such a bad thing.

How do you see the present landscape of the financial crisis, where we have in one hand innovation, social media and in the other hand crisis, unemployment and banking crisis?

We’re in a fast changing times but I don’t believe its something to fear. Looking back over history would we say the rise of manufacturing was bad for society as a whole? And yet the luddites fought against it. In 200 years we will all be creative, information based workers so I hope people will evolve, and up-skill quickly to remain employed.

What are the next steps for Quantconnect.com?

Next we’re looking to give engineers the best execution platform possible; taking your great ideas and executing them with your brokerage account. We’ll take care of all the infrastructure

You are from New Zealand and found a team that works between Chile and NY. How do you manage a global team in such different geographies, cultures?

Tricky at times! But Google Hangout works well! As a bonus in Hangout you get to play with colourful hats and disguises to lighten the mood. I have daily catch ups with some team members and work over email when the timezones are awkward.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.