Artificial Intelligence is at the forefront of a transformative wave that is reshaping algorithmic and quantitative trading. The questions for traders are: how AI benefits these trading strategies, what are the current trends, and how to identify profiles of some of the industry’s frontrunners.

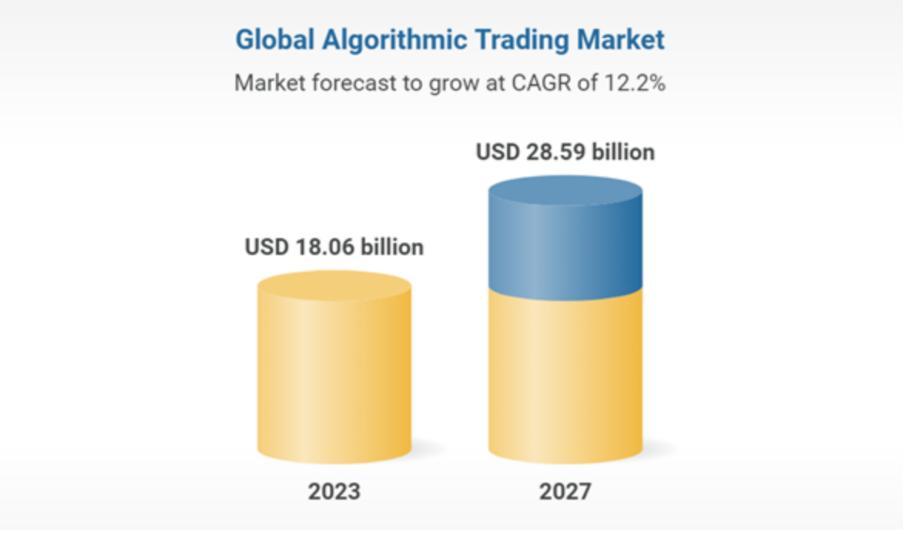

According to the Research Market Report 2023, the global algorithmic trading market is currently estimated at over $18 billion. It is expected to maintain steady growth, with projections indicating an approximate growth at CAGR 12.2% over the next five years.

According to Tradingview, by 2032, the algorithmic trading market is projected to balloon to $36.75 billion. Notably, the Asia Pacific region is poised for rapid expansion, while North America will maintain its position as the largest market in terms of size.

The future of algorithmic and quantitative trading appears poised for groundbreaking developments as the financial industry continues to embrace AI-driven solutions. Let’s dive into:

Current Trends in AI-Driven Trading

1. Explainable AI (XAI): As AI adoption increases, there’s a growing emphasis on making AI models more interpretable. In trading, it’s crucial to understand the reasoning behind AI-driven decisions.

2. Reinforcement Learning: Reinforcement learning algorithms are becoming more prevalent in trading strategies. These algorithms learn from experience and adapt to changing market conditions.

3. Crypto Quant Trading: With the rise of cryptocurrency markets, quantitative trading strategies are gaining prominence in the crypto sphere. AI plays a crucial role in optimising these strategies.

AI’s High-Frequency Trading (HFT) Edge

AI has become a cornerstone of high-frequency trading strategies. It enables traders to process market data at lightning speed and execute orders within milliseconds.

– Low-Latency Execution: Field-Programmable Gate Arrays (FPGAs) are the secret weapons of HFT. They allow traders to customise hardware for specific trading tasks, significantly reducing latency in data processing and order execution.

– Parallel Processing: FPGAs are inherently parallel devices, capable of processing multiple tasks simultaneously. This parallelism enables quick analysis and execution of trades on multiple instruments.

– Real-Time Risk Management: FPGAs contribute to real-time risk management. By calculating risk metrics like value at risk (VaR), they enable HFT traders to adjust their positions swiftly in response to market conditions.

The AI-Driven Revolution in Quantitative Trading:

Quantitative trading, often referred to as quant trading, is no stranger to data-driven strategies, but AI is taking it to new heights. Here follow some major directions, where the impact of AI gives an unprecedented shift

– Data Analysis and Pattern Recognition: AI, particularly Deep Learning, equips quant traders with the ability to analyse vast datasets. Neural networks excel at recognising intricate patterns and trends within financial data, helping quants make more informed trading decisions.

– Predictive Modelling: Deep learning models, such as Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks, assist in creating predictive models for asset price movements. These models forecast market conditions and inform trading decisions based on these predictions.

– Sentiment Analysis: AI has enhanced sentiment analysis for quants, enabling them to assess market sentiment more accurately. Quants can now analyse news articles, social media data, and other unstructured information in real time, providing deeper insights into market sentiment shifts.

Industry Front-runners in AI-Powered Trading

1. Renaissance Technologies: Known for its Medallion Fund, Renaissance Technologies is a pioneer in quantitative trading. Their secrecy and success have made them legendary.

2. Citadel: Citadel’s quantitative trading division is a powerhouse, using AI to drive trading strategies across equities, options, and other asset classes.

3. Jump Trading: A leading HFT firm, Jump Trading leverages cutting-edge technology, including FPGA-based solutions, for rapid execution and risk management.

4. Jane Street A prominent market maker, Jane Street is known for its quantitative trading strategies in financial markets. They embrace technology and AI for a competitive edge.

5. Eqvilent: Quantitative trading powerhouse that provides liquidity on financial markets worldwide using cutting-edge technologies in the fields of Deep Learning, FPGA, and Signal Processing. A relatively new player, but despite that, they already have conquered a significant market share in the Middle East, Asia and Europe and are growing exponentially.

Conclusion

AI enhances algo trading by optimising real-time execution, data analysis, risk management, and enabling HFT. For quant trading, AI empowers predictive modelling, portfolio optimisation, market microstructure analysis, and adaptive strategies. These distinct applications of AI align with the specific objectives of each trading approach, ultimately benefiting both in unique ways.

What is obvious, the future of algorithmic and quantitative trading is AI-driven, offering new opportunities for success and the potential for continued innovation in the world of finance.

Serafima is an executive level operations professional in fintech and web3 industries, who drives teams to the peak of performance.

With over seven years of experience in investment banking, trading, tech startups, and crypto, she has successfully managed projects across the UK, EU, Eastern Europe and Africa, working with organisations like Barclays, UN, Central Banks and major crypto exchanges. She has also strategically advised more than 10 startups, launched apps and fintech solutions for governments and the mass market, launched public sales and listed tokens on the exchanges.

As a COO, she oversees the day-to-day operations, supporting its growth and adding to its bottom line. She also consults and leads operations strategies for other tech startups, leveraging her expertise in DeFi and fintech. She believes that determination and persuasion are the best drivers for the business and loves creating systems and processes that optimise efficiency and effectiveness.