2019 has started quite turbulent in many markets around the globe, with economic growth on the brink of being halted. These headwinds have weighted and subsequently dragged investment funds of all kind, particularly Venture Capital and Hedgefunds, which had to divert their portfolios and pinpoint the companies where they had chosen to put their money into. More worryingly, investors around the world, looking at screens, smartphones or tablets have seen returns and profits heading south. So, at the start of 2019 the question everyone is asking is ‘where will we find value?’

According to ADSS market specialists, “for the last few years the low-interest rates in Europe and the US closed off a number of investment options and traditional safe-havens like gold and the yen have started to show reduced correlation to the market fundamentals.”

Meanwhile, in the US the dollar bulls may have been happy with life, especially in last year’s performance, with many also investing in US tech stocks; but falling iPhone sales, the US Government shutdown and the on-going Sino-US trade war is starting to weaken the greenback and the US markets.

“In 2019, it is clear investors will need to be less correlated with the main markets and look for contrarian calls to find the returns they are looking for,” warn the organisation.

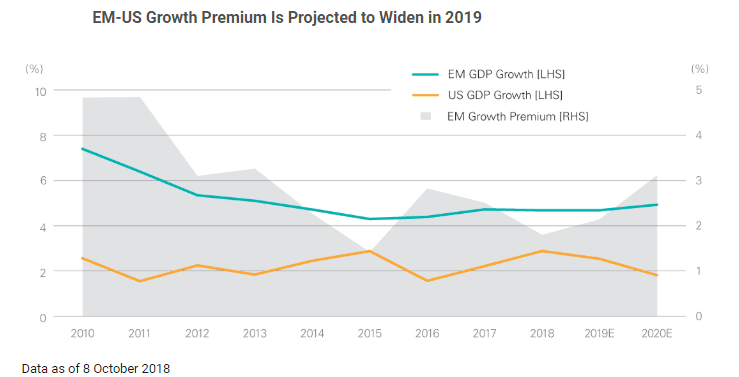

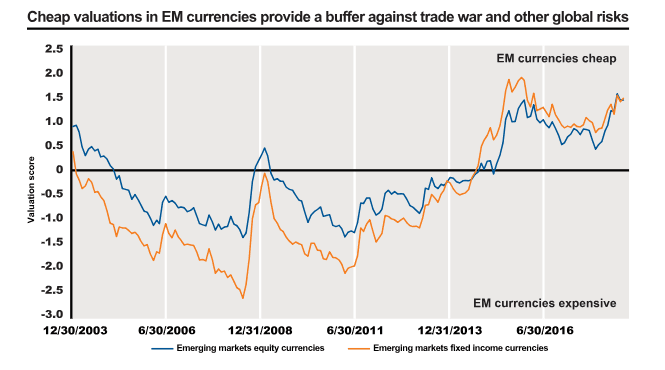

For that reason, investors should start looking at emerging market FX currencies as they may be an interesting place to look for value. The strength of the Dollar last year meant that many of them under-performed and one could say that they’re currently “cheap”, given relatively sanguine fundamentals.

Particularly the currencies strongly correlated to China and its economy have taken a beating on the back of Trump’s trade war but if a resolution is to be reached soon and the efforts of the Chinese government to engineer a “soft landing” for its slowing economy succeed then these currencies may see a strong recovery in 2019.

The odds of a weaker Dollar on the back of the Fed’s decision to slow down – or pause – its rate hiking schedule is also a bullish catalyst that can propel EM FX prices higher in the medium term.

Apart from that, ADSS strongly thinks that cryptos aren’t done just yet. “We also believe that there’s still value in cryptos, not in the “get rich quick” sense that permeated the market over the past few years, but in looking for a few specific coins that really stand a chance to become mainstream assets,” pointed out the analysts.

Following in their analysis, they stated that, “Ripple is one of them, adopted by many investment firms for its particular merits.” Ripple has built RippleNet, a decentralized network of financial institutions that can send and settle international payments on-demand. It is now active in over 40 countries , and its members have the ability of transacting with payment providers or digital wallets that they don’t have a direct relationship to, all within a regulated framework.

Given the now broadening regulatory adoption of cryptocurrencies, XRP may be one of the assets that will enjoy a good rally in the current year.

So for 2019 the ADSS advice is “to take a long-term view of the markets, reduce exposure to risk and look for less popular choices that may yield a good return. There will be many opportunities in emerging markets, and with new asset classes which allow investors to reduce main market correlation.

Unlike the hedge funds in 2018, clients who do not need to chase revenues and are looking at building wealth for current and future generations, will be able to have a very good year.”

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.