Apple Invests USD 1 Billion in China-Based Ridesharing Company.

In a day where the legendary Warren Buffet invested in Apple there are two things we know now about Apple: First, the company is serious about cars. Second, it’s ready to start looking beyond the iPhone.

Apple and cars

While it has remained mum on just about every rumor about its ambitions to build a proprietary car, Apple made an unprecedented decision to invest $1 billion in the “Uber of China,” Didi Chuxing.

So why would Apple put a billion dollars into a non-tech, non-consumer electronics company? Autonomous vehicles.

China has moved surprisingly rapidly to get autonomous cars on the streets. The country’s government recently released a draft proposal that would allow driverless cars on the country’s highways in 2020 and on city streets by 2025. Since Apple wants to create its own driverless cars, where better to invest than the largest car market on earth, which also happens to be the most progressive market in terms of getting driverless cars on the streets?

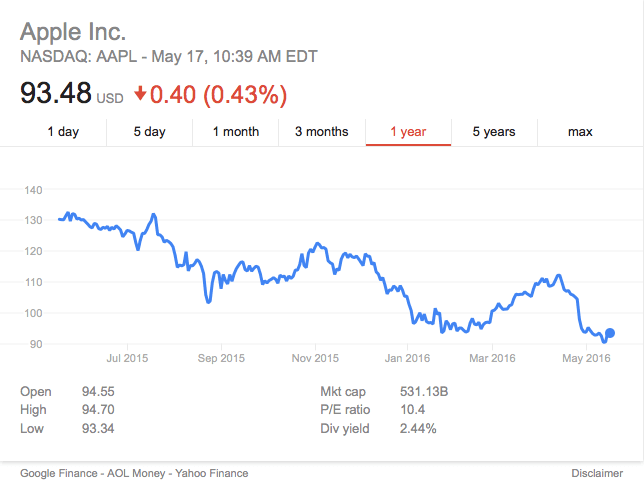

Apple’s product slowdown

We’ve said it before. Apple has finally reached a plateau in terms of innovation. Despite releasing several new products and services over the last few years — i.e. Apple Music, Beats Music, Apple Watch, Apple TV etc. — there hasn’t been anything compelling enough to turn into one of the company’s next big things. The trifecta of the iPhone, the iPad and the Mac is no longer what it once was. And the iPhone made up 65% of the company’s revenue during the latest quarter.

Considering Apple has never really invested in startups — if it sees something it likes, it just buys it to add it to its own fold — it sounds like Tim Cook is finally ready to admit that the Apple as we knew it is gone. Now it’s time for Apple to start using its cash to invest and hopefully insulate the company enough in case of an iPhone slowdown too.

Wooing China

Another potential reason for the investment is for Apple to get back on China’s good side. After all, why not just invest in Uber, which recently entered the Chinese market?

Apple has had some challenges in China recently. With smartphone sales for the company shrinking in the country, it lost an iPhone trademark dispute and has had some of its online entertainment services suspended following pressure from the Chinese government.

Of course, Apple’s not the only U.S.-based company struggling to cozy up to Chinese government officials. Dropbox, Google, Twitter and Facebook have all been banned from the country, likely due to the fact that they compete with Chinese tech companies.

Thus, one of Cook’s strategies could show that Apple is willing to get its own skin in the game in favor of China-based companies to show its dedication to the country’s own economic success. Whether that move makes a difference or not, of course, remains to be seen. As we’ve all seen before, the Chinese government is quite arbitrary in its decisions when it comes to U.S.-based tech companies.

One thing is for certain, however: Apple has entered a new frontier.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading