Ongoing supply disruptions across the global energy industry continue to drive oil prices higher despite the fact that output levels from key producers are still growing and inventories remain well above historical levels. Falling US production combined with supply outages in Canada and Nigeria and the prospects of economic collapse in Venezuela threaten to keep prices elevated as risks remain mainly biased to the upside near-term. While prices of West Texas Intermediate light sweet crude have not yet been able to overtake the critical $50.00 psychological level, factors currently in play could contribute to a test of the level in the coming sessions. Moreover, these developments come despite the potential for a production onslaught from other key producers that could beckon a new round of price competition to preserve market share.

Abundant Chaos in Key Producers

The Venezuelan economy on the verge of failure combined with extremely limited Nigerian output making it out of the country have contributed to the temporary factors giving oil prices a lift towards the key $50.00 per barrel level. In Venezuela, a state of economic emergency and lack of dollars have seen the local oil industry nearly grind to a halt. Little to no investment in maintaining the industry has seen production fall by nearly 200,000 barrels per day over the last 12-months, a figure which may drop further despite the nation boasting the largest proven reserves of oil of any producing nation. In Nigeria, the situation is much more dire, with nearly 800,000 barrels of daily production taken offline thanks to rebel advances in the Niger Delta. Additionally, the fires in Canada have resumed, threatening a renewed production pause in the oil sands region.

Offsetting the concerns about the developments in both Venezuela and Nigeria is rising production from Iran and plans to expand output even further in Saudi Arabia. April production in Iran surged above pre-sanctions levels, climbing to 3.560 million barrels per day, with exports rising to 2.000 million barrels per day. These figures are only expected to rise further over time, likely towards the 4.000 million barrel mark. Meanwhile, the replacement of long-time Saudi Energy Minister al-Naimi who was succeeded by former Aramco Chairman Khalid al-Falih might also be a bid to raise production in the Kingdom towards 12.000 million barrels per day, a move that would flood markets and pressure prices even further. Plans are already underway to bring in new technology thanks to ongoing efforts to list a portion of Aramco, paving the way for foreign oil companies to enter the region and contribute know-how in an effort to improve recovery.

Production Falls and Prices Rise

Although last week’s 3.410 million barrel US inventory drawdown gave producers some relief after driving prices higher, inventory data continues to underline the fact that stockpile declines are not sizeable enough to really dent the vast supplies already in storage. In fact, earlier figures from the Energy Information Administration shows that Cushing inventories are back on the rise, increasing by 461,000 barrels last week, echoed by the 1.310 million barrel gain in total onshore storage during the same time period. Even though US production continues to ease, falling to 8.791 million barrels per day, the lowest since September of 2014, prices remain unmoved. The kneejerk reaction in WTI following the announcement was negative, but prices recovered, climbing back above $49.00 per barrel after a limited drop.

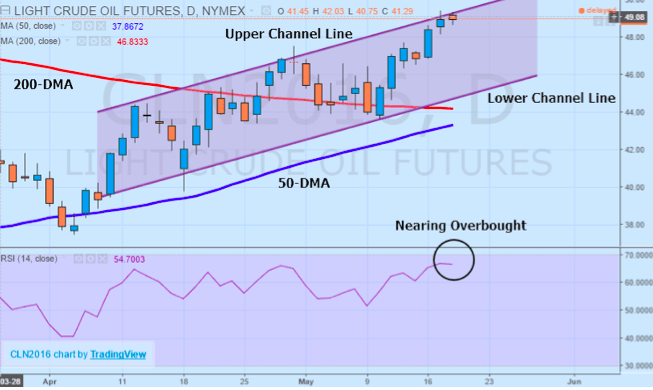

From a technical perspective, oil prices continue to trend higher within an equidistant channel pattern that has a distinctly bullish bias. However, based on the fact that WTI is trending near the upper channel line, now may not be optimal timing to establish a position. Ideally, a bullish position would be considered near the lower channel line unless a candlestick closes below the lower channel line, indicating a reversal lower. When taken in combination with the relative strength index, prices are just shy of the overbought 70 level, indicating a near-term pullback could be in order. One interesting development however is the flattening of the 200-day moving average and the rising 50-day moving average. A crossover would add to the bullishness of the channel pattern with both moving averages currently acting as support against any downturn in prices and pushing towards the $50.00 level.

Moving Forward

Even though near-term risks are clearly skewed to the upside based on the potential for further disruptions to supply, on a more medium-term basis, the emphasis may move back towards extremely high onshore inventory levels. Falling production has not translated to a major drawdown in US oil inventories, a factor that may play a greater significance in the coming months if demand fails to rise and supply stays unchanged. However, in the meantime, the supply-side of the equation will continue to dominate the discussion, with any further unresolved disruptions likely to push WTI futures towards and even above the $50.00 psychological level.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading