The US economy is regaining momentum at the end of the first quarter after a temporary slowdown, with business activity rising to its highest level since September 2014.

Markit Economics’ gauge of US service activity climbed 1.5 percentage point to 58.6 in March. The composite index, which measures services and manufacturing activity, rose 1.3 percentage point to 58.5.

Service sector output also increased at the fastest rate since September 2014, with payrolls rising at the strongest level in nine months. The March survey also signaled the fastest increase in incoming new work in six months.

However, managers are concerned about the business climate. The percentage of service providers expecting a rise in business activity over the next year fell to its lowest rate since June 2012, a sign uneven global demand could weigh on the domestic economy.

“While the surveys signal that economic growth will have slowed in the first quarter from an already modest 2.2% pace seen in the final quarter of last year, the upturn in the surveys in March provides a clear advance indication that stronger economic growth will return in the second quarter,” said Chris Williamson, chief economist at Markit.

He added, “While weak economic data for the first quarter will keep Fed rate hikes at bay in coming months, ruling out a June hike, the upturn in second quarter GDP signalled by the recent PMI data ups the odds of interest rates starting to rise at the September FOMC meeting.”

The FOMC is expected to raise interest rates at least once this year. According to analysts, a September rate hike could leave room for one more rate adjustment before year’s end, as the Fed continues to face a barrage of political pressure about normalizing monetary policy.

Central bankers lowered their median outlook on interest rates to 0.625% by the end of the year, down considerably from the 1.125% forecast in December. This suggests interest rates will be very slow to normalize, despite improving fundamentals. Central bankers also lowered their GDP forecasts over the next few years.

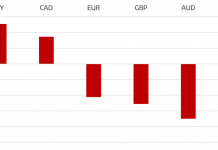

In currency news, the US dollar appears to be moderating after its post-FOMC selloff. The US dollar index, which tracks the performance of the greenback against six other currencies, consolidated around 97.14. It had dropped more than 3 percent since last Wednesday.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading