A Beginner’s Guide to Crypto Trading is 4 part guide covering all you need to know about crypto trading. In this third part, we focus on the exchange plazas where cryptocurrencies can be traded, along with storage solutions to keep them safe.

Once we fully understand the basics of cryptocurrencies in the last entry of this guide and the technology behind them, the blockchain, it is time to get our hands ‘dirty’ into the main plazas where these cryptos can be traded: the exchange market.

Despite being mostly investment products in nowadays trader hands, cryptos can only be traded in special exchanges. Due to their digital nature and partially non-regulated by governments and international institutions, cryptocurrencies requires special needs only provided by these exchanges.

3.1 The Digital Wallet

In fact, these cryptocurrencies -also called tokens for they are built after digital company platforms- can only be hold in digital wallets. There is no such thing as physical token and therefore all coins must be storage into the blockchain where that crypto has being built.

These e-wallets work as usual pocket-wallets but just ‘exist’ in the internet. It is basically an address in the blockchain where through a personal password can be accessed to. Being written in the blockchain gives our wallet extra security as if someone trying to access to it without our permission, it will be spotted and stopped by others users throughout the blockchain.

Each wallet has a public address and a private address. The public address is the address that people send funds to. The private address is the “password” that you use to access and send your funds. Some experts recommend to write down on paper the private address or key and delete from the computer/device you are trading from as it is easier for a hacker get into your computer rather than hack your wallet.

“Never expose your private key until you are ready to spend your funds, otherwise you will probably lose all the money in your wallet.”

One wallet will work for all exchanges the same our bank account can be used in all commerces. So there is no need to open different wallets in every exchange as we can use the same wallet for all of them.

Now that you understand the basics of cryptocurrency wallets, let’s look at the different wallet options out there. Here are the different ways that you can store your loot, as shown by crypto-trader Hugh Kimura:

-

Online wallet: This is probably the easiest way to store your money. But it is also the least secure. So it’s not a good long term storage solution, but it is fine for buying things and funding your trading accounts. Exchanges like Coinbase also have their own wallets built in.

-

Mobile wallet: You can download a mobile app like Mycelium to store your spending money. It is more secure than an online wallet, but if your phone ever breaks or it gets hacked, everything in your wallet will be gone.

-

Desktop wallet: Similar to a mobile app but just for desktop computers.

-

Hardware device wallet: These are hardware devices that are built especially for storing cryptocurrency keys. They are safer than the options above, but they are still susceptible to the things that can damage all electronic devices.

-

Paper wallet: You can also store your private key on paper. This is the most hacker proof, but it is also the least convenient. If you are going to go this route, be sure to store them in a safe place (like a safety deposit box).

3.2 The Crypto exchanges

Now that we are familiarized with the storage solutions for our bitcoins, it is time to pick the exchange where we are going to trade at.

There are dozens of exchanges out there specifically trading cryptocurrencies. They all offer bitcoin and similar trade in options along with fees for using them. So choosing the right one will mostly depend on our own trade goals.

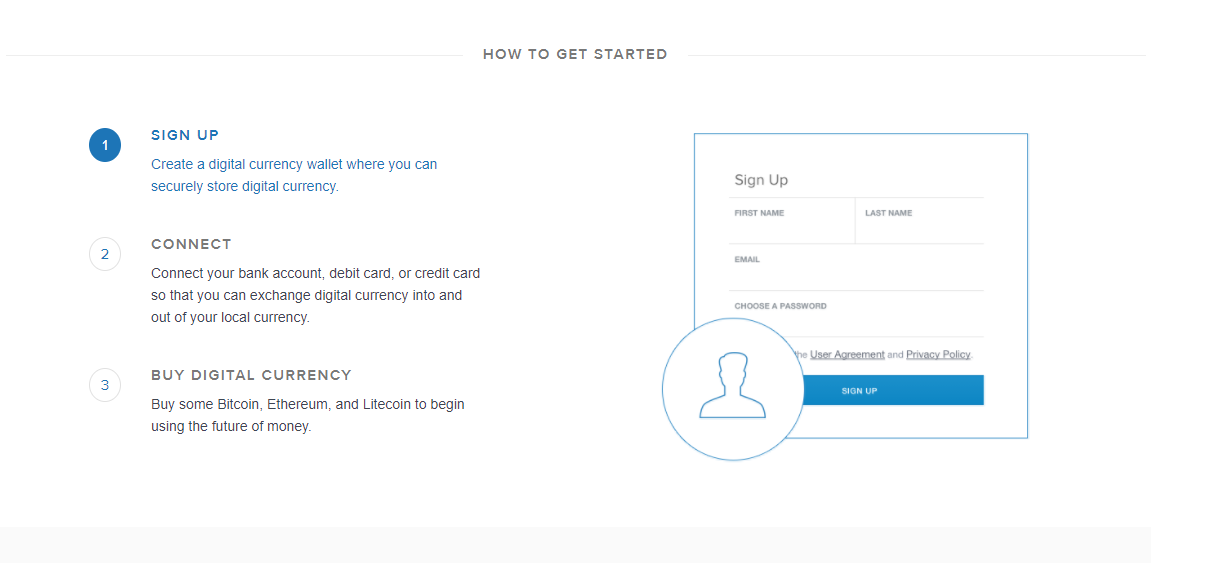

As a beginning point, the easiest and most popular exchange is Coinbase. Offering a limited amount of assets -currently only Bitcoin, Ethereum and Litecoin are listed- it serves more than 10 million investors all around the world in 32 countries.

“Starting from Coinbase is a good option as if our goal is to expand to other smaller tokens we will have to do an exchange from Bitcoin to another cryptocurrency.”

The process to start trading in Coinbase is quite straightforward. It accepts debit or credit card to buy Bitcoins. And to get our hands into some brand new Bitcoins we will just to sign up using the following steps:

Despite Coinbase, there are other exchanges that offer same assets, here is a list of the bigger ones:

3.3 Going deeper into the token world: Buying Altcoins

All experts recommend to start with Bitcoin when trading cryptocurrencies as it is the most common and accepted token. However, the cryptocurrency world is vast enough to full fill everyone’s needs and goals and there are hundreds of tokens offering different types of investment experiences, from long-term projects to ICOs company assets.

The best way to take a look at the crypto-market is through Coinmarketcap, a list of all cryptocurrencies out there. Click in any of it to discover more information and check out if it suits to your objectives.

Once you have picked your token, open an account at the most reputable exchange on the list. When you are in your account, find the “deposit” wallet address for the altcoin you want to buy.

3.4 Step-by-step guide to buy Altcoins

Here is a step-by-step guide to buy altcoins from Bitcoins. The process can slightly differ depending on the exchange we are trading at though they all follow the same patterns:

-

Login to the account where you bought your Bitcoin or Ether. If you bought it from Coinbase, then you can go to: Accounts > Send and paste the deposit address into that field.

-

Enter the amount you want to send, then click the send button. It may take some time for the transaction to go through, so be patient.

-

When you see the balance in your destination exchange account, you are now ready to buy altcoins.

-

Now go to the Exchange area of the website.

-

Then click on the BTC tab. These are the currencies that you can exchange for Bitcoin. Click on the altcoin that you want to trade.

-

Next, scroll down and look for the buy/sell box. Enter the amount of altcoin that you want to buy.

-

If you want to trade all of your Bitcoin, click on the link at the top with your total balance.

-

Click the Buy button and you are all set. The trade might not happen right away, so check your Orders > My Open Orders page to see the status.

As said in the beginning, the exact process will be different at different exchanges, but the basic idea is the same for all exchange.

Here you can find a full list of all cryptocurrency exchanges.

Following these steps will granted a satisfactory trade experience when investing in cryptocurrencies. Although you must carry on with precaution as crypto coins are a risky product. So make sure you don’t do any misstep reading our last entry in this guide tomorrow with some tips and important final considerations.

Part 4 can be found here.

Part 2 can be found here.

Part 1 can be found here.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.