US nonfarm payrolls rebounded sharply in April, offering convincing evidence the labour market was on solid footing following an abrupt hiring slowdown in March.

Nonfarm payrolls increased by 223,000 in April, in line with the consensus estimate of 224,000, the Department of Labor reported on Friday. Nonfarm payrolls growth in February and March combined were revised down by 39,000, as employers added just 85,000 jobs in March, well below the previous estimate of 126,000.

With the April results, nonfarm payrolls growth averaged 191,000 over the past three months.

The unemployment rate fell to a new seven-year low of 5.4%, in line with forecasts. The government reported on Thursday that weekly jobless claims remained near 15-year lows last week, underscoring the improving labour market.

Job creation was concentrated in a few sectors in April, including professional and business services, health care, construction and transportation.

Employment declined in mining and was little changed in major industries like manufacturing, retail, financial activities and government, official data showed.

Despite the increase, earnings growth continued to trend on the low side. Average hourly earnings for all private sector employees rose by just 3 cents or 0.1% to $24.87. Hourly wages had increased by an average of 0.2% the previous month. Compared to April of last year, average hourly earnings were up 2.2%.

Tepid earnings growth will probably give the Federal Reserve more leeway in keeping interest rates highly accommodative. The Fed has struck a more dovish tone in recent months, despite dropping the word “patient” from its official rate statement. Policymakers are reportedly at odds about when to begin adjusting the federal funds rate, which has been held near zero for nearly six-and-a-half years.

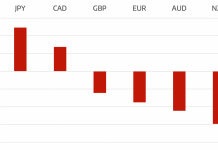

In currency news, the US dollar was little changed following the jobs report, as a dimmer economic outlook continued to cloud the world’s most actively traded currency. The dollar index, which tracks the performance of the greenback against a basket of six currencies, dipped 0.1% to 94.52.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading