Trading Volatility and Performance and the Opportunities and threats for the Financial Industry!

- What does the future hold for trading volumes and market structure?

- Fintech boom – an opportunity or a threat for financial services?

- Is the global economy out of the woods?

- Will “rate rage” save the euro or sound its death knell?

These are some powerful questions to put in the context of the global trading and investment industry. These questions are the main driver of the edition of event #TradingDebates.

After ten years of low market volatility and low interest rates, it is only now that the global markets are beginning to feel the repercussions and the question marks are still out there.

Analysts from top trading and investment banking industries all around the world are seeing a staggering plunge in transactional volumes along with deal flows. And the questions are still more than the answers. Whether you are bull or bear the markets are far from peaceful days and traders and investors see shifts continuously happening. As the notion of forthcoming rate spikes in developed nations draws near every moment, it is still uncertain whether or not the investor will be ready for what everybody is calling a ‘new normal’ in the financial industry.

Nevertheless, a midst the dark or grey (whatever you prefer) clouds of uncertainty and doubt there is a light shining in the form a new more interesting positive renaissance in financial technology and all the new innovation coming from new Fintech proposals. And it seems like it has captured the interest of a several new players in the market.

#TradingDebates

Following a successful series of debates Saxo Capital Markets is proposing a new event that with a powerful display of some of the most influential personalities of the industry proposes a reflection about the present of the trading industry for traders and analysts alike.

#TradingDebates the outsanding event organised by Saxo Capital Markets and its flagship TradingFloor.com returns with a new key series of discussions and analysis on a range of issues relating to trading volatility and performance and at the same time reflecting on the new advent of innovation and technology in Finance – The Fintech new wave that London leads worldwide.

The event has been a successful one, both on the location and also on the digital arena where #TradingDebates, has been leading a fantastic social media engagement that recently was nominated by the Social Buzz Awards for the best Social Media Campaign of 2014.

Event Details

October 22 the fourth instalment of #TradingDebates at the British Museum brings an event with various financial experts, analysts and gurus that will come together to debate the future of the financial markets in light of the volatility that surrounds it. But also among the threats it aims to reflect the more positive emergence of Fintech and the opportunities this innovative variant brings to the financial and trading industry as a whole.

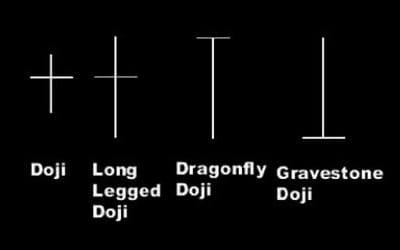

This year’s #TradingDebates will emphasise mostly on the consequences of low volatility that has been around for more than ten years causing interest rates to plummet in various financial markets across the globe. And if this volatility increases and if an interest rate hike occurs, it will mark a new phase of market volatility.

The debates will open with an insightful speech from Matteo Cassina, who is the Head of Saxo Bank’s Business Lines. He will be talking about “The Evolution of the Markets and Innovation”. After the speech, Cassina will sit with a panel to discuss the considerable transition of the financial markets in ‘What Does the Future Hold for Trading Volumes and Market Structure?’

Editor for the Financial Times UK, Phillip Stafford will be arbitrating the panel, a panel of experts that will seek to explore an alteration in trading activity which has now been significantly fashioned by a plethora of technological innovations, regulatory intrusions and structural moves. There will be valuable insight provided on the subject by the CEO of Turquoise, Dr. Robert Barnes, Andrew Bowley (Nomura), Sarah Hay (UBS) and James Davis, who is a partner at Oliver Wyman. All would be discussing the various ways market participants can successfully stay on top of the game.

A sheer drop in transactional volumes and deal flows has leveraged the rise of various prospects in the industry of financial technology. Anna Irrera, a reporter at Trading & Technology, will be overlooking a panel of brilliant financial minds, namely Julian Skan (Accenture), Javier Tordable (Eurexhange), Gerald Brady (Silicon Valley Bank) and finally, Ian Morgan, the Director of financial services at Google UK.

The panel will be discussing how the Fintech ‘boom’ has provided a new, more opportunistic door into the financial industry, creating waves in the market structure. The debate on ‘Opportunity or a Threat for Financial Service’ will measure and question how efficiently the traditional world of trading cross paths with the new investment.

The Financial Time’s own chief commentator, Martin Wolf, will discuss the ‘Shifts and the Shocks: What We’ve Learned and Have Still to Learn from the Financial Crisis’. Wolf will then discuss the probability of ‘weak’ monetary policies and programs which have done nothing but add fuel to the interest rates hikes in ‘Is the Global Economy Out of the Woods?’

Then, a panel including Danny Gabay (Director at Fathom Consulting) and Steen Jakobsen (Chief Economist at Saxo Bank) will delve in a discussion regarding should the central banks start to overturn QE and regularize policy. The respected speakers will talk about whether or not investors are ready for what could be a massive asset price correction.

The event’s last panel will discuss ‘Will ‘Rate Rage’ Save the Euro or Sound its Death Knell?’. Despite the fact that you can see a potential increase in the growth rate of both the US and UK economies, it is also true that analysts predict an era of weakness for the Euro. But, is the fall in Euro a possible answer for, or a particular symptom of the Eurozone economic depression and deflation?

The evening’s final panel will be overlooked by Jonathan Ferro (Bloomberg) and the panel will feature Kit Juckes (Societe Generale), Erik Britton (Fathom Consulting), Geoffrey Yu (UBS) and John Hardy (Head of Saxo’s FX strategy).

More on: https://www.tradingfloor.com/topics/trading-debates

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading