One of the most commonly-asked questions among novice traders is “Should I use technical or fundamental analysis?”. Well, there are a lot of traders that swear by one, and there are a lot that swear by the other – mainly because they are better at one than another. But for most traders, the answer is that you should use both – and use them for things that play to their particular strengths.

Technical analysis is the use of past price action to forecast future movements, whereas fundamental analysis looks at economic and political news for signals that a currency pair may move one way or the other. Fundamental factors can rapidly change the technical outlook, while technical analysis can sometimes explain moves that fundamentals can’t. Both types have a direct influence on price action, because they are both widely used by traders. Therefore, you need to comprehend the benefits of each type of analysis, and have a good idea of when to use one or the other.

Generally speaking, the broad themes in the market – whether it is ranging or trending, and in what direction – are determined by fundamentals. Technicals, on the other hand, are useful for determining entry and exit points for trades, because so many other traders are using the same indicators to place their orders. Fundamentals do not usually change quickly, often lasting for months or years, but when they do change it can have a huge impact on the values of currencies.

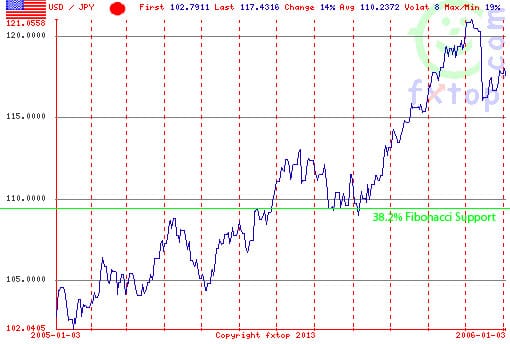

Here’s an example of how we might use both types to make a move. Back in the middle of 2004, the Fed began bumping up interest rates by a quarter of a point at a time. They made their plans for an extended period of rate tightening widely known beforehand, and in 2005 they increased interest rates by 200 basis points as promised. This prompted a huge rally in the value of the dollar that lasted the whole year.

During 2005, the dollar appreciated 19% against the yen, but during the year there were a number of retraces. These provided lots of opportunities for traders to combine technical with fundamental analysis to find the best times to enter these trades.

Based on the fundamentals, it was clear that the dollar would remain on an uptrend as long as rates kept going up. This allowed traders to rely on technical analysis to identify opportunities to buy dips rather than sell rallies.

Source: FXTop.cop

For example, during the rally from 101.70 to 113.70, the retracement paused on the 38.2% Fibonacci support, providing traders with a perfect entry point for the trade – based on fundamentals, but using technicals to determine the entry and exit points. Trying to pick out tops or bottoms for the USD/JPY during 2005 would have been tricky, but with the bullish trend so obvious, it was easier to follow the fundamental theme and trade with the trend rather than against it.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading