Yes, I cannot deny I am not too impressed with the latest NFP (nonfarm payrolls, for those of you that are new to reports and want to understand more) it makes perfect sense if you think about, now, that is “IF” you do. Keep in mind, we are not too far from having another “Wanna Be” in power, and this time the expectations are higher.

But, when you have to bad apples running to be “Master of the Universe” or for what is worth just another public figure making a few million here and there, we have to stop and think about the numbers and how they do not make sense anymore.

Inflation is low to none, credit expanded and twisted our economies and yet! All is good, or that’s what the majority likes to believe in.

As we all face a high degree of uncertainty, I have to think about this issue more and more. It is not only Nonfarm Payrolls or CPI (consumer price index), maybe GDP (gross domestic product) It has turned to be every single number out there because most of them come with a bag of makeup. You and me, cannot trust black and white date as we used to do.

Why?

I imagine our expectations have changed (like a lot) and we are not content or satisfy with the reality, we need to create something way above our means. That’s why we have a situation in the euro where it does not matter how bad things are and will be; it keeps going up…yes! Not forever and ever, but in the short-term it delivered so many surprises to a decent number of traders that I am betting are short somewhere around 1.5000 to 1.0890.

Then, NFP comes out; it is not in the estimated forecast and the pair EUR/USD does nothing. Take a moment to review your chart; sure there was a spike and some shows discussing and over analyzing every possible perspective that adds no value at all, but! We all have to make a living.

If Nonfarm Payrolls does not matter as it used to; what is important now?

The sick and clueless Central Banks decisions. That’s so hot right now. It makes me laugh, one banker says: “We still monitor the economy and have all tools available to act if necessary.” Market participants want to anticipate any price action; then they start buying and selling to find themselves later that same week trapped or waiting for a reversal.

Central Banks forecast or economy support through their set of tools have created this parallel universe, so it does not matter anymore if you have a premium report coming out, and it is positive for the related currency you are trading, just wait because the market might digest the information way different from what seems to be the most visible reaction.

That’s exactly how I changed my market view, from placing trades based on Central Banks to use technical analysis to find entries and pre-determined exit points. I let them talk, I let them publish any numbers they feel are necessary. In the end, I am in control of my risk where those numbers good or bad are nothing more than the catalysts to keep the trading world going up, down or sideways. This attitude that I call “Whatever” empowers you as a trader and human being, because it pushes You to think and allocate only the necessary risk into your positions. It can make you free and eventually, will help to improve your trading results. So, I think is time for You to do the same!

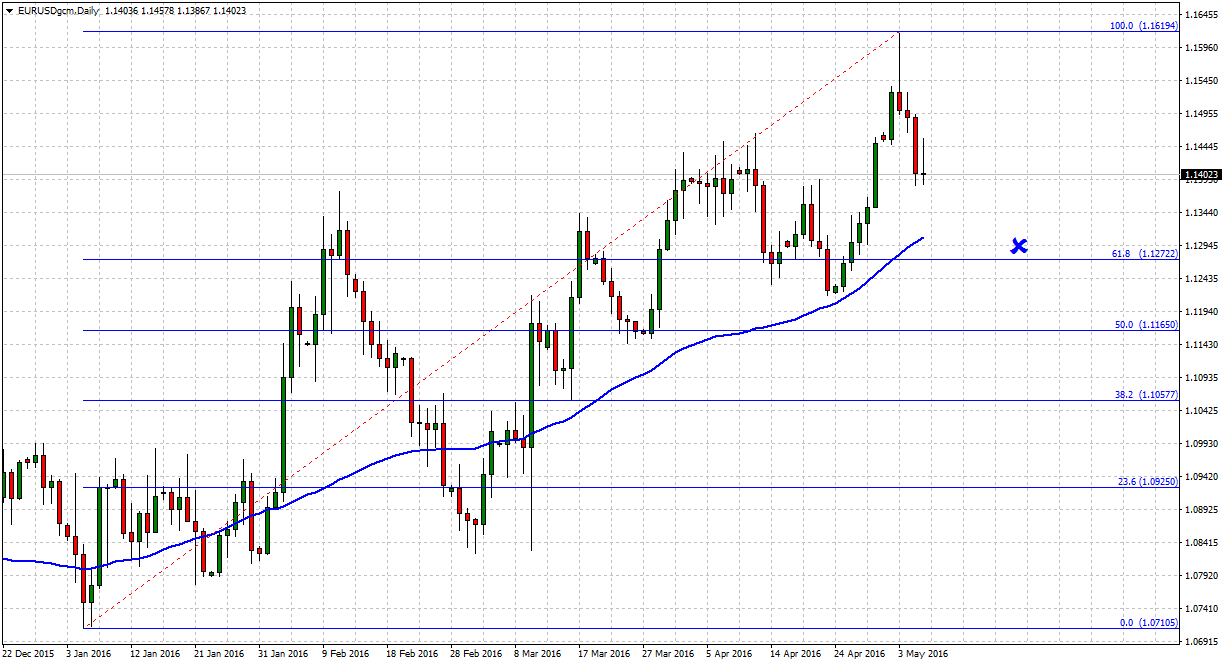

First off, the EUR/USD was ready for an interesting predicament; Nonfarm Payrolls. I do not discount how this report or news may affect other pairs, but let’s face it all eyes were on the Euro.

Nothing great, the currency was trending lower for a couple of days after reaching a new high in 2016 around 1.1619; fancy, right? So, my best guess is that tons of sellers thought the high was enough and accumulated new shorts. However, focus on trend direction and using a simple method; 50 SMA you can understand that the game is not over for the risk takers.

I marked with a blue “X” where it is expected to have buyers and as usual, (may look more like a coincidence) a Fibonacci Level; 61.8 – 1.1272.

Have been bullish the Euro for a while now, but I have some doubts in the coming weeks with the Brexit drama. So, if buying when the market opens you are taking something around 240 pips at risk. For sellers, the risk is similar to the upside +200 pips to start a short. Either way, it looks to me very 1:1 risk and reward ratio, then we should all wait. I am positive, you all understand how patience works; right?

Trend Direction: Prices Above 50 SMA – Bullish

Fibonacci Levels: Interested Around 61.8% and 50.0% To Add New Long Positions

Target: Expect a Double Top 1.1619 or higher

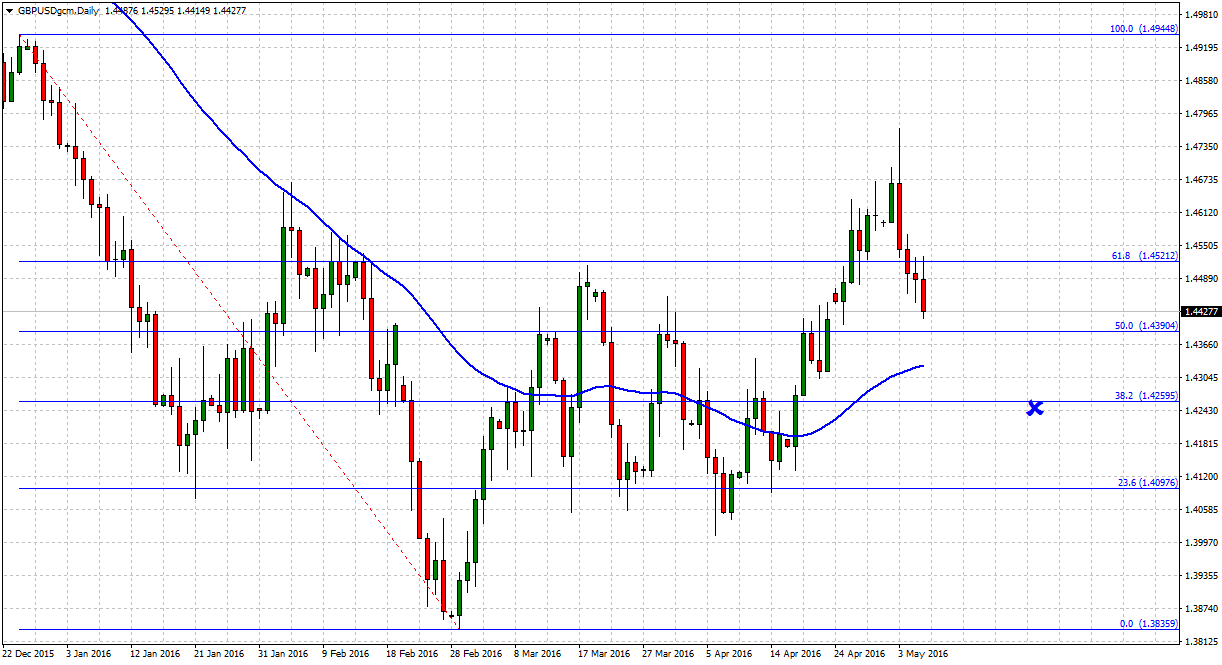

Let’s continue and review the cable; can’t recall when was the last time someone called GBP/USD like that because nowadays everything is Brexit and more Brexit (boring enough if you ask me).

Again, it can still push towards 1.5000, and bad US data support this idea.

You can see a blue “X” around 38.2% – 1.4259 again, the game is not over if you want to take more risks.

Using a 50 SMA, I find the trend and start making decisions. It’s simple but, effective. You do not see ten indicators and five moving averages on these charts. We want to focus only on risk. If you manage your Risk, you can win in forex trading. But, please! It is not different from any other asset class.

Trend Direction: Prices Above 50 SMA – Bullish

Fibonacci Levels: Interested Around 38.2% To Add New Long Positions

Target: Expect Inverted Head and Shoulder 1.4944

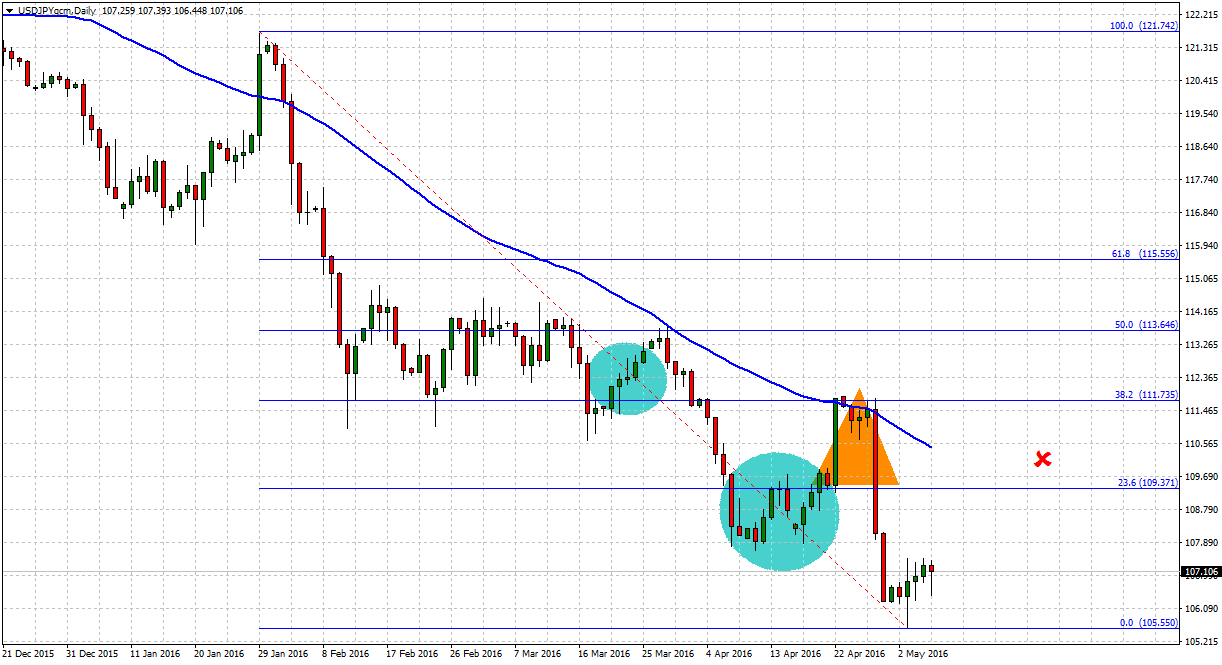

Have you heard that repetition is the key to success? Well, looks like banks, speculators, and Hedge Funds are just waking up, wait for not even that…They all have a mirror on their desk and every 30 minutes repeating! Mirror, Mirror make BoJ (Bank of Japan) feel sorry for us and our bonuses and please, let the intervention be a reality for us.

I took the liberty to draw two sorts of blue eclipses to show you the zone where USD/JPY made a pullback.

Tell me this, Does it look the Japanese Yen has any intentions to go up?

Forget about “Interventions” or any “Voodoo” tactics you think BoJ will provide because that Bazooka has one more shot and they are not going to waste it saving traders and investors. They have one and one goal only, and that is to protect their people and country. (although It is not like they know how to make it happen, they will try)

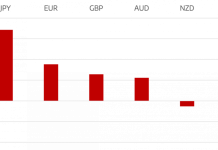

Trend Direction: Prices Above 50 SMA – Bearish

Fibonacci Levels: Interested Between 23.6% and 38.2% To Add New Short Positions

Target: Expect NO Intervention – 100.00 is real!

That’s about it! It does not matter anymore, just face the new facts. We do not reward real metrics; we reward words and empty promises.

Nonfarm payroll and any other data can be spectacular if Central Banks want to control the impact they will do it. In this process, they are happy to destroy the free market.

Questions, comments or ideas? Leave your feedback in the box below. I am always reading and answering your messages.

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.