NYSE Euronext has released a statement announcing a settlement with SEC in a response to charges that the New York Stock Exchange has broken a rule which determines the timing of delivery of certain exchange market data. The SEC has also accused that NYSE has not retain some computer files in violation of SEC record-keeping rules. Firstly, NYSE Euronext did not admit the infractions.

The settlement says that NYSE Euronext has agreed to pay a US$5 million fine for keeping an independent consultant to evaluate NYSE Euronext’s U.S. exchanges’ current Rule 603(a) compliance systems, and to implement the consultant’s recommended improvements. The allegatins were aimed at differentials in the speed of NYSE’s delivery of market data from 2008 to 2010.

NYSE completed systems changes in the following years that eliminated the technology issues that were the subject of the investigation. They also keep omputer files that were the subject of the records-retention charge.

Hotspot frustrates in August

Hotspot has announced a very volatile and slower than thought August for FX investors. The firm has had a loss of US$ 4 million in the month. It suffered a decrease in volume resulting in an average Daily Volume (ADV) of US$21.0 billion. Hotspot FX’s market share was 8.4% in August 2012. That is up from 7.8% in August 2011.

Insight Investment Management Limited has announced that will aggregate Pareto Investment Management Limited and all of its affiliates to the Insight Group. Pareto has more than £27 billion in assets under management. The transaction still has to be approved by regulatory agencies.

“Insight and Pareto are a natural fit as the businesses have a similar risk management philosophy and client-centric approach. Pareto’s expertise in currency is complementary to our current risk management and investment capabilities and the transaction supports our objective of providing holistic risk management solutions to our clients”, stated Abdallah Nauphal, CEO and CIO of Insight.

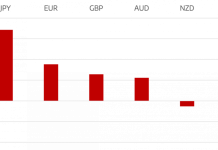

Dollar falls to near 7-month low

The dollar has fell to approximately seven-month lows against the most important currencies this Monday on what could be a consequence from the Fed‘s announcement of an active monetary policy for the following months. The move also pushed the euro to a four-month high against the American currency and the yen to a seven-month record.

The promised a week ago to keep purchasing mortgage bonds until unemployment falls significantly. “The outlook for the dollar has definitely been damaged by the policy actions by both central banks 0 the Fed and the ECB,” has told to Reuters Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington.