Today, we will be looking at how the Elliott Wave Theory can be practically applied when trading forex. In order to do this, we will look at some trade setups, and use our knowledge of Elliot Wave Theory to help us choose entry, exit, and stop loss levels.

Example 1

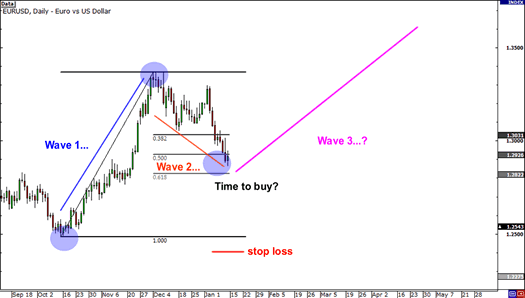

So, let’s assume that you wanted to begin your wave count, because you have noticed that the price seems to have bottomed out, and that a new upwards move is in evidence. Therefore, using your Elliott Wave Theory knowledge, you label this upwards move as Wave 1 and label the retracement as Wave 2.

Remember our rules for drawing Elliott Waves from the previous part? Well, here’s where they come into play – using them to decide how to set up your trade. In this case, these are the most relevant rules and guidelines to this situation:

Rule 2: Wave 2 CANNOT go beyond the start of Wave 1

Waves 2 and 4 frequently bounce off Fibonacci retracement levels

Therefore, you set up the Fibonacci tool to see if the price is indeed at a Fibonacci level, and in this case, it is sitting quite neatly around the 50% level. This means that we could be looking at the start of Wave 3 – a very good time to place a long trade.

Now that we have our entry level, it’s time to look into where to put your stop. Remembering Rule 2, which states that Wave 2 can never go beyond the start of Wave 1, you decide to set your stop below the previous lows at the start of Wave 1.

Then, if the price retraces more than 100% of Wave 1, then you will know that you have set up the Elliott Wave in the wrong way. Let’s look at what happens next…

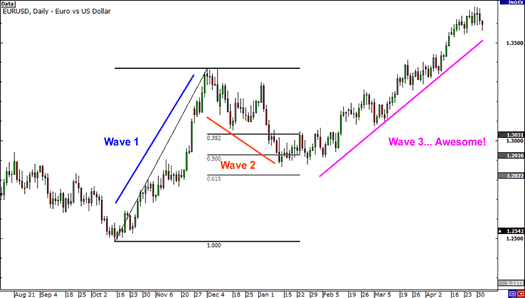

In this case, it turns out that your Elliott Wave analysis was spot-on, and it allowed you to catch a huge upwards move. In the next (and final) part, we will be looking at another example of using the Elliott Wave Theory in practice, as well as summarising the main points from this series.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading