The forex market is one of the most volatile trading environments around, and this coupled with the high levels of leverage that are required for independent traders to get into the market in the first place can make it a very risky endeavour. While there are techniques that you can use to manage risk, which we covered in greater detail in this recent forexthink article, there are some risks that traders are often unaware of, or forget about, when they are trading, and many of these are psychological.

1. Timing

Don’t be lured into trading by the prospect of making big money fast. If a trader is too hasty, he may find that he puts himself at risk of overtrading – that is, making more trades than he has the time to really research, analyse, and think about. Remember, quality is much more important than quantity when it comes to placing trades.

2. Boredom

Sometimes, there just isn’t much action in the market or your trading system can’t catch any of the moves. A trader might put himself at risk by getting restless and too eager to get a slice of the market. Play caution by stepping back from your charts and take a break by visiting trading forums or research the markets.

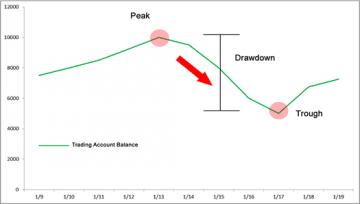

Probably the most obvious risk a trader faces is the danger of your account facing a drawdown. This is when a trader’s account faces a peak-to-trough decline during your period of investment. Naturally, this can have a fairly devastating effect on both your financial situation and your trading confidence, which is why it is necessary to have a risk-management system in place that provides a buffer against losing streaks.

4. Drawups

You can also face risks when your account rises in value or incurs a drawup. The main problem here tends to be that overconfidence can start to sneak in, leading to dramatic increases in position sizes. The most effective way to counter this is to have a trading strategy in place and stick to it.

5. Ego

It’s important for traders to always keep their ego in check. A few big wins can leave you feeling like a market wizard – but always remember that luck has a big part to play, and you should always have humility whether you are on a winning streak or not. Failing to do so can lead you to be lax with your trade execution. A smart trader always sticks to his trading plan.

6. Overconfidence

Traders are at risk after they’ve gone through a series of wins thinking that they’ve mastered the markets. Overconfidence can lead to making bad trading decisions such as taking on too many trades and abandoning crucial trading plans.

7. Fear

Alternatively, a series of losses may make you doubt yourself or your trading strategy, leading you to deviate from your trading plans and make bad trading decisions.

8. Sequencing

No matter how well you manage your trades or how consistent your trading system is, you never really know in advance the sequencing of your winning and losing trades. The risk here is when the trader begins to take the sequencing of his wins and/or losses out of statistical context.

9. Lack of Motivation

If you see your account balance bouncing up and down without any real progress, you may read it as a sign that you’re not improving. Even in times of alternating wins and losses the risk here is that you perceive this negatively and lose motivation.

10. Don’t forget the bigger picture

Using a trading journal will allow you to put things into perspective so you can see the bigger picture. So keep track of your stats, put in the work and always update your journal. The best way to address foreseen problems is to align your psychological risks to actual risks.

Remember that being a forex trader is a full-time job. Although you may not be trading 24/7, there’s always work that needs to be done.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading