In the previous installment of our Guide to Forex Trading with Fibonacci ratios, we looked at how to combine the Fibonacci tool with trendlines and exhaustive candlestick formations. Today, we’re going to see how we can use Fibonacci extensions to set price targets.

For example, in an uptrend, it might be an idea to take profits on a long trade a Fibonacci extension level. To do this, select a significant Swing Low, drag the cursor to the most recent Swing High, and then drag the cursor to click on any of the retracement levels. This will show you each of the Fibonacci extension levels with the ratio and the corresponding price.

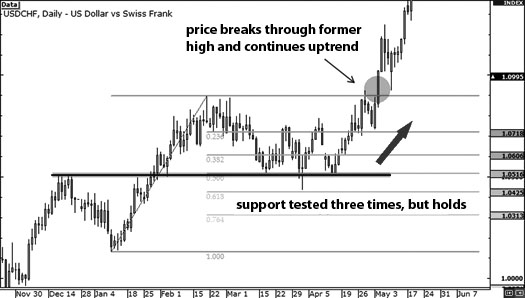

To illustrate, we’re going to return to the USD/CHF example we looked at in part 3. Let’s go back to that example with the USD/CHF chart we showed you in the previous lesson.

In this example, the 50% Fibonacci level served as a strong support, withstanding three tests before the pair resumed its uptrend, with the price going above the Swing High. Now, let’s use the Fibonacci extension tool to suggest some take profit levels.

After the retracement Swing Low, the price rallied to the 61.8% level, close to the previous Swing High, before finding support at the 38.2% level. The price then rallied again a couple of days later before finding resistance at the 161.8% level. So, as we can see from the chart, the 61.8%, 100%, and 161.8% levels would all have been good places to set take profit orders.

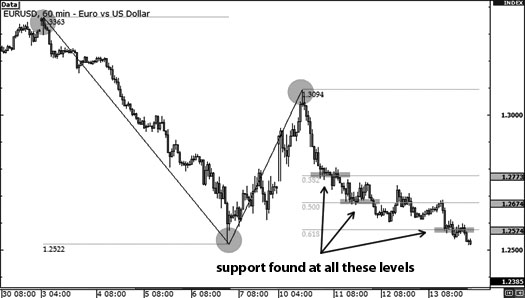

To illustrate this process in the context of a downtrend, we’re going to use the EUR/USD chart we looked at when using Fib retracements in combination with exhaustive candlesticks. In a downtrend, the basic idea is to take profits on a short trade at a Fibonacci extension level, as it is common for the market to find support at these levels.

In this case, a doji formed just below the 61.8% Fibonacci level before sellers took control of the market and the price tumbled to the level of the recent Swing Low. Now, we’re going to use the Fibonacci tool to determine where we could have placed take profit orders if we had shorted at that 61.8% retracement level.

In this case, the 38.2%, 50.0%, and 61.8% extension levels would have all been good places to take profit, as the price found some support at each level before continuing the downtrend.

First, the price found support at the 38.2% level before heading down to the 50% level, which held as an initial support before becoming an area of interest. Then, the price fell again to the 61.8% level, which also became an area of interest before price fell again to the previous Swing Low.

So, we could have set take profit orders at the 38.2%, 50.0%, or 61.8% levels. All these levels acted as support, probably because other traders were looking at these levels as well.

In both the examples above, the price finds temporary resistance or support at the Fibonacci extension levels. While this doesn’t happen every time, it does so often enough to make it worth your while using extensions to set profit targets.

There are a few potential issues with this tactic, however. For starters, it’s impossible to tell which Fib extension level will provide support or resistance, as any of these levels may or may not do so.

Also, it can be difficult to know which Swing Low or Swing High to start with when setting the Fibonacci levels. In these examples, we have used the most recent ones, but you could also use the lowest Swing Low (or the highest Swing High) from the past 30 bars. There is no technically correct way to do it – you just have to try things out and decide what works best for you. Ultimately, you need to show a bit of judgement when using the Fibonacci extension tool, in terms of how long the trend is likely to continue. That’s why it’s often worth combining these techniques with other forms of analysis to gain a broader picture of price trends, and determine their strength.

In the final part of our series on Forex Trading with Fibonacci Ratios, we’ll be looking at using the Fibonacci tool to set stop losses and manage your risk.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading