Huddleston Capital Markets FX Quarterly Commentary

General Overview

“They say that breaking up is hard to do. Now I know; I know that it’s true. Think of all that we’ve been through. And breaking up is hard to do. ” The second quarter 2016 can be summarized by this Neil Sadaka classic reminding us of the difficulty of splitting up.

The proposed break-up of the UK from the EU has been the driver in the foreign exchange markets this summer. After the June 23rd referendum, markets immediately unsettled. Government bond yields fell sharply, with 10-year U.S. Treasuries yielding below 1.40%, their lowest levels ever, and yields on European and Japanese 10-year debt became even more negative. Most poignantly, the once venerable British Pound depreciated to levels not seen in 30 years against the US dollar.

As the initial turmoil around the Brexit vote subsided, the market’s appetite for risk has dropped. Cautious sentiment has buffered safe haven currencies. European funding currencies have found levels of support; and commodity based currencies continued to weaken. After spiking to historic highs, implied volatilities have collapsed, reflecting the market’s expectations of narrowing trading ranges for most currency pairings over the next few months as the world continues to digest the new long term realities brought about by Brexit.

In addition to the projected parting of the ways between the EU and the UK, the health of Italy’s banking sector, concerns around a growth slowdown in China, and the upcoming U.S. election (we should all be concerned with this one) all stoke market fears. In doing so, they support the greenback and the yen. Both continue to outperform, because as the old adage states (and I’m paraphrasing) ‘In the land of the blind, the one eyed man with a cataract and macular degeneration reigns supreme.’ Right now, the US dollar is that man.

USD

Despite some mixed data in the second quarter, unsettled financial markets have provided support for greenback. In spite of risk associated with the upcoming U.S. elections, which have been on full display this week and last, the USD remains a safe haven currency. US dollar also received support from the Fed’s July statement, “Near-term risks to the economic outlook have diminished.” Analysts far and wide interpret the statement as implying the Fed may hike rates, perhaps as early as the September 21 meeting. In the near term expect modest USD strength, which should further USD gains against risk-sensitive currencies. Implied volatilities in most pairings vs. the USD are down.

- Q2 GDP rose 1.2% q/q annualized, much less than expected!

- Q2 employment cost index rose 0.6% q/q.

- Jobless rate increased to 4.9% in June.

- Inflation rate held steady at 1.0%

- June nonfarm payrolls jumped 287,000.

- Average hourly earnings firmed slightly to 2.6% y/y.

- The June ISM services index rose to 56.5.

- ISM manufacturing index rose to 53.2.

- Real consumer spending rose 0.3% m/m.

- Industrial output fell 0.4% m/m.

- The May core CPI firmed slightly to 2.2% y/y.

- Core PCE prices were steady at 1.6% y/y.

- The Federal Reserve kept monetary policy steady in June.

Implied Volatilities

EUR/USD: 1 Month At-the-Money Volatility 6.89%

USD/CAD: 1 Month At-the-Money Volatility 7.73%

USD/JPY: 3 Month At-the-Money Volatility 10.98%

Euro (EUR)

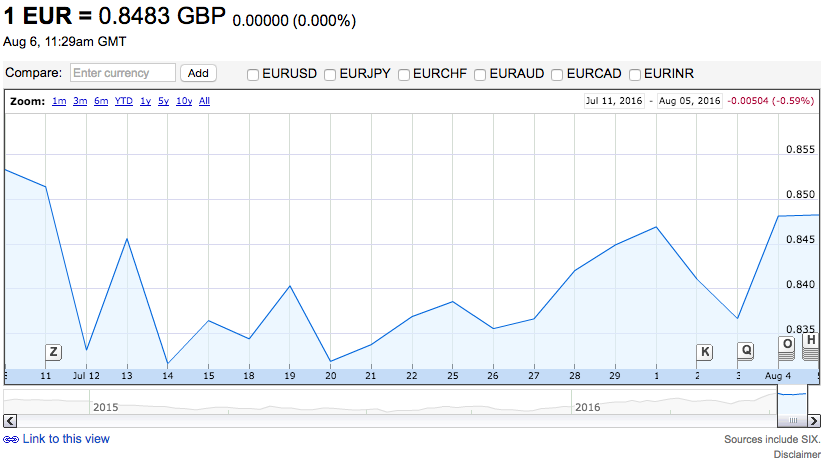

Not surprisingly, the Brexit vote put downside pressure on the EUR, but in spite of the jitteriness it seems likely that the EUR union will weather the initial volatility stemming from the UK’s vote to leave the EU, which could see the GBP/EUR exchange rate further ceding ground. EUR/USD will likely soften further over time due to the juxtaposition of the possibility of further ECB monetary policy adjustments and Fed tightening. Expect weakness in the EUR. FX positioning also point to the EUR’s decline vs. the USD but rise vs. the GBO.

- GDP rose a mere 0.3% in Q2 after 0.6% in Q1, or 1.6% y/y.

- July CPI firmed to 0.2% y/y.

- Core CPI was steady at 0.9% y/y.

- Eurozone June manufacturing PMI rose to 52.8.

- PMI fell to 52.8. June economic confidence eased to 104.4.

- France got zero growth after 0.7% in Q1.

- Flash CPI is 0.2% after 0.1% in June.

- Spanish unemployment fell to 19.9%.

- Greek unemployment fell to 23.3%. ( Just think about that for minute.)

- German unemployment rate hit a record-low of 4.2% in June. The lowest level since reunification.

- Germany’s June IFO business confidence rose to 108.7.

- In Ireland, three senior bankers are going to jail, if for only 2.5-3.5 years, over the 2008-09 crisis. It’s about time.

Current EUR Rates

EUR/USD: 1.1175

EUR/GBP: 0.8455

EUR/CAD: 1.4560

EUR/JPY: 114.35

Implied Volatilities

EUR/USD: 1 Month At-the-Money Volatility 6.89%

EUR/GBP: 1 Month At-the-Money Volatility 10.72%

EUR/CAD: 1 Month At-the-Money Volatility 7.29%

EUR/JPY: 1 Month At-the-Money Volatility 10.74%

Recommended Enhanced Yield Structure: Long EUR/GBP Forward.

- Long EUR/GBP forward at 0.8455 for 2-Weeks.

- Sell 2-Week EUR Call/GBP Put with 0.8494 Strike (39 Delta).

- Forward’s implicit deposit rate is – 0.92%.

- Yield from US dollar cash position 0.76%.

- Yield from option premium is 10.33% annualized.

Structure’s yield is 10.17% annualized from deposit rates and the option’s premium plus potential capital gain from EUR appreciation to 0.8494.

Australian Dollar (AUD)

In contrast to the expected tightening of the Fed, the Australian central bank has maintained a dovish bias. Mixed data, including a jump in business confidence and a dip in consumer confidence, political jitters, low commodity prices and slow Chinese growth remain key headwinds for the Australian economy. Inflation remains subdued and domestic demand is relatively soft. The net result will be a weaker Australian dollar over time. That said, FX positioning also offers scope for short-term Australian dollar strength.

- GDP Growth rate increased to 1.1% y/y from 0.6% y/y.

- The unemployment rate was steady at 5.7% for June.

- Inflation rate dropped to 1.0% for Q2 from 1.3%

- June business conditions were steady at +10.

- Business confidence fell to +3.

- The June manufacturing PMI rose to 51.8.

- Services PMI fell to 51.3.

- May retail sales rose 0.2% m/m, while private sector credit eased to 6.5% y/y.

- Q1 house prices unexpectedly declined 0.2% q/q.

- The central bank kept its Cash Rate at 1.75%.

- S&P lowered the country’s outlook to negative from stable but affirmed its AAA rating.

Current AUD Rates

AUD/USD: 0.7595

EUR/AUD: 1.4710

AUD/NZD: 1.0545

AUD/JPY: 77.60

Implied Volatilities

AUD/USD: 1 Month At-the-Money Volatility 10.70 %

EUR/AUD: 1 Month At-the-Money Volatility 10.05%

AUD/NZD: 1 Month At-the-Money Volatility 11.22%

AUD/JPY: 1 Month At-the-Money Volatility 15.05%

Recommended Enhanced Yield structure: Long AUD/USD forward.

- Long AUD/USD forward at 0.7581 for 2-Weeks.

- Sell 2-Week AUD Call /USD Put with 0.7605 Strike (49 Delta).

- Forward’s implicit deposit rate is 0.98%.

- Yield from US dollar cash position 0.76%.

- Yield from option 11.65% annualized.

Structure’s yield is 13.39% annualized from deposit rates and the option’s premium plus the potential capital gain from AUD appreciation vs. USD to 0.7605.

Great British Pound (GBP)

Not surprisingly, uncertainty surrounding the country’s vote to the leave the European Union weighs on growth and future investment inflows. Reuters reports, “Within bond portfolios (For UK managers), exposure to UK government securities tumbled by some 6 percentage points to 33.1 %, while investors added the same amount to their holdings in U.S. Treasuries and Canadian bonds.” This does not bode well for the GBP/USD. Adding to the bearish outlook for the GBP, the Bank of England recently suggested it would ease during the summer. Additionally, FX positioning and technicals offer scope for further GBP downside. Bottom line: it’s not a good time for GBP bulls. Interesting note: Implied volatilities for most GBP pairings remain elevated beyond historic volatilities. This represents an excellent opportunity for use of the Enhanced Yield Strategy.

- UK consumer confidence fell to -12 from -1 in June, the lowest since April 2012 and the biggest one-month drop in 26 years.

- GDP Growth rate increase to 0.6% for June.

- Unemployment rate decreased to 4.9% in May.

- In May industrial output fell 0.5% m/m.

- Retail sales softened slightly to 0.9% m/m.

- The manufacturing PMI rose to 52.1.

- Services PMI softened to 52.3.

- Trend earnings growth was steady at 2% y/y.

- May CPI inflation was steady at 0.3% y/y.

- Core CPI was steady at 1.2% y/y.

Some Current GBP Rates

GBP/JPY: 135.05

GBP/USD: 1.3230

EUR/GBP: 0.8440

GBP/CAD: 1.7240

Implied Volatilities

GBP/JPY: 1 Month At-the-Money Volatility 17.09%

GBP/USD: 1 Month At-the-Money Volatility 12.28 %

EUR/GBP: 1 Month At-the-Money Volatility 10.67%

GBP/CAD: 1 Month At-the-Money Volatility 11.11%

Recommended Enhanced Yield structure: Short GBP/ JPY 2 Forward. Long JPY

- Short GBP/JPY forward at 135.05 for 2 Weeks.

- Sell 2-Week GBP Put/JPY Call with 133.85 Strike (36 Delta).

- Forward’s implicit deposit rate is -0.50%.

- Yield from US dollar cash position 0.76%.

- Yield from option premium is 23.10% annualized.

Structure’s yield is 23.36% annualized from deposit rates and the option’s premium plus the potential capital gain from JPY appreciation vs. GBP to 133.85.

Canadian Dollar (CAD)

Economic activity remains uneven, and the Bank of Canada is on hold, but the central Bank has taken on a more cautious tone. Bank of Canada Gov. Poloz expressed cautious optimism toward the Canadian economy, noting that “continued patience is required.” Sentiment surveys have softened. Inflation remains close to target despite some recent slowings. Further oil price increases have provided support for the loonie, but their halt will undermine Canadian dollar support. Eventual Fed rate hikes, extended FX positioning, and technicals all suggest renewed Canadian dollar declines over time.

- GDP increased to 0.6% for Q2, up from 0.2%.

- Jobless rate dipped to 6.8% in June.

- Inflation hold steady at 1.5%.

- Manufacturing sales jumped 1% m/m.

- The May trade deficit fell slightly to C$3.28B.

- May CPI inflation slowed to 1.5% y/y.

- Core CPI inflation eased to 2.1% y/y.

- The Q2 Business Outlook survey showed firms’ sales outlook declining to +5.

Some Current CAD Rates

USD/CAD: 1.3030

GBP/CAD: 1.7240

CAD/JPY: 78.30

Implied Volatilities

USD/CAD: 1 Month At-the-Money Volatility 8.03%

GBP/CAD: 1 Month At-the-Money Volatility 11.12%

CAD/JPY: 1 Month At-the-Money Volatility 13.62%

Recommended Enhanced Yield structure: Long USD/CAD forward.

- Long USD/CAD forward at 1.3030 for 2-Weeks.

- Sell 2-Week USD Call/CAD Put with 1.3100 Strike (34 Delta).

- Forward’s implicit deposit rate is -0.01%.

- Yield from US dollar cash position 0.76%.

- Yield from option premium 10.40% annualized.

Structure’s yield is 10.39% annualized from deposit rates and the option’s premium plus the potential capital gain from USD appreciation vs. CAD to 1.3100.

Japanese Yen (JPY)

Consistent with the theme du jour, expect the yen to remain supported in the near term due to its status as a safe haven. As market jitters wane and the focus returns to economic and monetary policy trends, we’ll see yen weaken over the medium term. Japanese economic activity worsened. Sentiment surveys were subdued, and deflation deepened. The Bank of Japan left monetary policy steady in June and repeated that it would continue easing until its inflation target is achieved. Further easing is possible, which could weigh on the yen over time. Stretched FX positioning and technicals hint at a resumption of yen declines in the mid-term.

- March GDP rose 0.5% y/y.

- June Unemployment dropped to 3.1%.

- Deflation rate remained -0.4% for June.

- Manufacturing sales jumped 1% m/m.

- In the Q2 Tankan survey, the large manufacturers’ index was steady at +6.

- Large non-manufacturers’ index fell to +19.

- Capital spending plans rose 6.2%.

- In May data, industrial output declined 2.3% m/m.

- Labor cash earnings unexpectedly fell 0.2% y/y.

- The May current account surplus narrowed to ¥1415B.

- The national core CPI (ex. fresh food) fell 0.4% y/y in May.

- CPI ex fresh food and energy eased to 0.6% y/y.

- Tokyo’s June core CPI declined 0.5% y/y.

Some Current JPY Rates

AUD/JPY: 77.60

USD/JPY: 102.10

EUR/JPY: 114.35

GBP/JPY: 135.05

Implied Volatilities

AUD/JPY: 1 Month At-the-Money Volatility 15.05%

USD/JPY: 1 Month At-the-Money Volatility 12.00 %

EUR/JPY: 1 Month At-the-Money Volatility 11.47%

GBP/JPY: 1 Month At-the-Money Volatility 17.09%

Recommended Enhanced Yield structure: Short AUD/JPY forward.

- Short AUD/JPY forward at 77.36 for 2-Weeks.

- Sell 2-Week AUD Put / JPY Call with 77.10 Strike (39Delta).

- Forward’s implicit deposit rate is –1.77%.

- Yield from US dollar cash position 0.76%.

- Yield from option premium 23.78% annualized.

Structure’s yield is 22.77% annualized from deposit rates and the option’s premium plus the potential capital gain from JPY appreciation vs. AUD to 77.10.

Mexican Peso (MXN)

With global markets likely to remain unsettled, the peso will remain under pressure. Expect modest weakness before a recovery over the medium term. Recent central bank actions have been peso-supportive. Domestic demand growth has been steady on balance. The government announced spending cuts of US$1.7B to help reach its deficit-reduction targets. Further central bank monetary tightening would offset expected Fed rate hikes. Existing short positions offer scope for further MXN declines.

- March GDP dropped to -0.3% y/y from 0.8%.

- June Unemployment dropped to 3.93% from 4.03%.

- Inflation rate remained 2.54% for June.

- June sentiment surveys were sharply lower–the services PMI fell to 47.8.

- Manufacturing PMI fell to 47.5.

- The May trade deficit narrowed to US$527M.

- June consumer price inflation slowed to 2.5% y/y.

- Core CPI firmed to 3% y/y.

- Mexico’s central bank raised its main policy rate 50 bps to 4.25% in June.

USD/MXN rate is 18.7530

USD/MXN: 1 Month At-the-Money Implied Volatility is 12.30 %

Recommended Enhanced Yield structure: Long USD Deposit / Short USD Call vs. MXN

- Long USD deposit.

- Sell 2-Week 18.75 Strike USD Call / MXN Put (22 Delta).

- Yield from US dollar cash position 0.76%.

- Yield from option premium is 8.46% annualized.

- Structure’s yield is 9.22% annualized from U.S. deposit and the option’s premium.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading